Sign In to Your Account

Subscribers have complete access to the archive.

Sign In Not a Subscriber?Join NowThe Financial Situation

Nineteen Twenty Two As a Year for Constructive Effort

MERRYLE STANLEY RUKEYSER

EACH new year the cumulative force of the world's business and finan cia! intelligence is directed upon the unknowable-the future. Although pre cise foretelling of future events is im possible, the whole structure of the uni verse of barter is based on prevision. Without it, sellers would not hazard to anticipate demand, and production would endlessly lag behind consumption.

In the period of inventory taking, from which we have just emerged, riddies solved and untangled have been tabulated. President Harding tagged this movement, away from the shifting sands of inflation and war-time propaganda, as the return to normalcy. The movement in this direction in America in 1921 was striking, and the nation's business starts the new year infinitely freer from the need of undoing the accomplishments of abnormal times. Expressed in human terms, men of initiative are once more liberated to devote their talents to constructive enterprises, instead of having to concentrate on the sloughing off of fungus growths.

To the investor, the last half of 1921 was a time of quickening in the stream of events. More occurred in the matter of a radically changed price level in those months than ordinarily happens in a generation. And the adjustment was all the more remarkable because it was generally foreseen and regarded as inevitable by intelligent observers.

In the spectacular depression of 1920, bonds at unprecedentedly low market quotations reflected the tension in the money market. The borrower had his back to the wall, and in the mad scramble for reluctant dollars, rates soared with the facility of a toy balloon. To bring themselves into line with prevailing conditions, outstanding bonds, which had come into being in earlier years, de dined in price. The recent spurt really constituted a recovery.

There were period~ of irregularity and reaction late last year, as those with profits, in some instances, sold their Se curities to convert their nominal gains into actual cash.

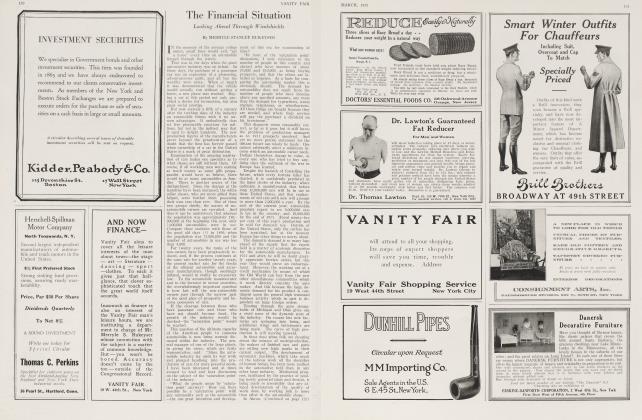

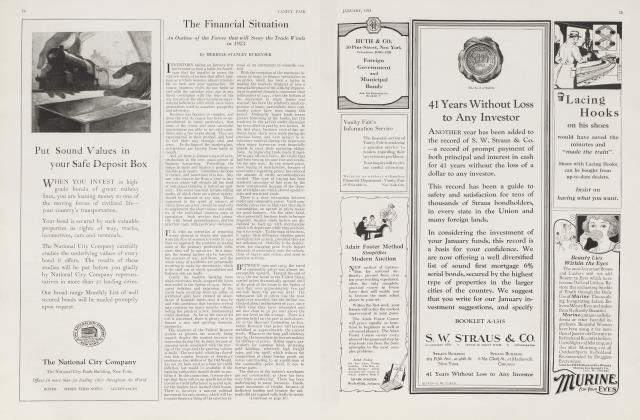

AS a measure of profits, the following list shows the advances in typical groups of bonds between September 1st and December 1st:

High Grade RailsPrice Price Adv.

Sept.1 Dec.2

Atchison. Topeka & Santa Fe

Gen. 4s 1995 78 1/4 85 1/4 7

Canadian orthern 78. 1940.. .103 7/8 110 6 1/8

Orand Trunk Deb. 75. 1940.. 103 3/4 110 1/4 6 1/2

Nor. Pae.. Gt. Nor.. Burl.

CoR. 6%s. 1936. 102 1/4 107 3/8 51/8

N. Y. Cent.. & Hud. Ricer 3 ½8.

1997 66 5/8 73 1/4 7

Union Paciilc 1st 48. 1947 82 88% 6

Second Grade Rails-

Baltimore & Ohio Ref. & Gen.

A. 5s. 1995 72 1/8 80 7 7/8

Chi.. Mil. & St. Paul Gen. &

Ref. A. 4 1/2s. 2014 59 5/2 60 5/8 1 1/8

Erie Con. Gen. Llo:t 4s. 1996 42 1/4 46 3/4 4 1/2

Norfolk 3outhern 1st & Ref. 5s.

1961 44 1/2 53 8 1/2

St. L.-San. Fran. Cum. Mi.

6s. 1955 68 1/4 73 4 3/4

Industrials-

Am. Smelt. & Ref. 1st 5s. 1947 17 3/8 88 4 5/8

Dianicud Match 7%s. 1936.... 104 3/8 107 2

Goodyear 1st Ss. 1941 102 1/4 109 1/8 6 7/8

General Electric Deb. 5s 1952. 87 96 1/4 9

U. S. Rubber s. 1947 78 1/4 85 6

U. S. Steel 58, 1963 95 98 7/8 3 7/8

Public UtilitiesDetroit Edlsoei 1st & Ref. B.

Cs. 1940 89 1/4 100 3/4 10 3/4

Duquesne Light 1st CoIl. 6s 93 1/4 100 3/4 7

Montana Power 1st & Ref. 5s.

1943 86 3/4 93 3/4 6 3/4

Niagara Power 5s. 1932 91 9424 3 3/4

Paciflo Gas & Else. Gen. &

Ref. 5s. 1942 79 3/4 89 3/4 10

Now, in connection with the foregoing exhibit, it is well to remember that foremost in the Wall Street credo is the homely truth that "you can't go broke taking profits." Ordinarily the doctrine is sound, but the recent situation in bonds was wholly exceptional. Profit taking was justified by dealers, and even by investors—to a lesser degree—where it was possible to make advantageous switches.

Yet for the great mass of investors it was and still seems more advisable to retain sound bonds, whose market price has substantially enchanced, than to sell them for the purpose of making a profit, All good bonds have risen, because the country is on a different basis of interest rates. The dollar lent will not earn as much as a year or two ago, and therefore what is made in selling one bond will be absorbed in purchasing another,

FROM the beginning of August to the outset of December the average price of twenty-five representative bonds climbed from 76.15 on July 1, 1921, to 83.61 on December 8, 1921.

In their rise in price, bonds have been losing some of their sombre dignity, Bonds, as any class room student in -finance can tell you, constitute investments, the latter being devices for placing funds where security of principal and regularity of interest are the prime considerations. An investment is not supposed in theory to yield a profit, merely a steady stream of interest payments and ultimately the return intact of the principal sum. Securities that enhance in market value are commonly regarded as speculative. A speculation involves the assumption of larger risks in the expectation of profit.

But in 1921, far greater profits were to be made in investments than in specu lations. The event was cruel, in so far as it tended to break down scientific distinctions about the process of ex changing cash for engraved certificates of an infinite variety.

In spite of the sharp rise in bonds in the last half year, the outlook is for still higher bond quotations and lower intcr-. est rates.

In January and July, investment or ganizations wax enthusiastic over the prospects resulting from a reinvestment demand. Translated into ordinary lan guage, the reinvestment demand results merely from the availability of funds obtained by investors by the gentle art of clipping coupons from bonds and of receiving dividend checks on stocks that remain productive. Into the reservoir of irivestable capital, more than $350,000,000 was scheduled to be poured by the reinvestment tributaries. Other things being equal therefore, January and July are months of heightened op portunity for the borrower to get funds, and for the banker to resell securities to the final coitsumer

Despite the stimulus likely to result from the impetus to reinvest, even the most unrestrained optimist cannot expect bond prices to rise with the celerity with which they have moved in recent months. If they did, the money market would soon attain a stage where the investor would go humbly to the borrower and, not only forego all interest rates, but would also offer to pay a service charge for the safekeeping of his funds. And scarcely twelve months ago, interest rates were unprecedentedly high!

SO revolutionary have the changes in America's financial position been since 1914, that pre-war times seem almost pre-historic. On this basis, 1901 or thereabouts would be looked upon as the stone age, when mankind first came to recognize the serviceability of blunt instruments. At any rate, early in the twentieth century the corporations of highest credit standing, particularly the stronger railroads, were able to sell bonds to the public on a basis to yield 4 per cent or less. Securities of this character yielded well over 6 during the recent monetary stringency, and their special market position, resulting from excellent distribution, prevented them from completely reflecting the strain. At present, the underlying railroad bonds of the strongest roads are closer to a 5 per cent basis, and the highest grade industrial bonds are coming to yield 6 per cent or less. The opportunities to get 7 and 8 per cent on the best type of securities is fast vanishing, and only exceptional vigilance among neglected bonds, especially of smaller and less known corporations, will afford high safety without sacrifice of return. And yet bond values have yet to rise considerably before they attain the levels of the early part of the century.

(Continued on page 8)

(Continued from page 6)

Good business and conditions approaching a boom in the world of industry are not prerequisites to an upward movement in bonds. In fact, diminished volume of trade and lower prices, such as have characterized the most recent phase of the business cycle, make for easier money, and higher bond quotations.

Improved business is reflected and anticipated in the shares of corporations, the common and preferred stocks which represent part ownership. With liquidation substantially completed in many industries, the outlook seems favorable for the shares of strong corporations which are engaged in an essential and profitable industry. Over the long pull, observers are inclined to perceive opportunities in copper shares, oil shares, stock of the railroad equipment companies, and others, but these considerations involve specific speculative decisions about which generalizations are often misleading. The speculator assumes risks for society, and his specific problem, which must be reexamined in the light of every significant economic and political development, is to determine whether a given stock is attractive at a particular price.

As the difficulties of readjustment become less menacing, the prospects for better and more lucrative business activities get brighter. Against the industrial rainbow appear, however, clouds which make for uncertainty. The most striking of these is the European economic and finance situation.

As Frank A. Vanderlip, just back from the Old World, recently remarked before the members of the Bond Club of New York: "Hardly a nation in Europe is balancing its budget. Now to balance a budget is a difficult thing for any nation, but it has proved to be an impossible thing, apparently, for almost every nation on the continent. When a budget is not balanced there are just two recourses left to a finance minister, if he cannot cut down expenses, if he cannot raise taxation to a point where his income equals his outgo; he can make loans, if he has the credit to do that, or he can print paper. Most of them have printed circulating notes. Not all. There have been notable exceptions.

"I have suggested that we look upon Europe as a debtor in difficulties, and that we bring to bear some of the principles which we rely on every day, when we come in contact with a debtor in difficulties. Europe needs help, direction, something to revive her spirit, and I believe that with the debt that is owed us —Europe's $11,000,000,000 debt to the United States Treasury for advances in connection with the war—we have in our hands an instrument of great power, great power for good, great power for bringing back a situation which has grown desperate.

"I believe that. it would be possible for us to direct certain expenditures over there in a way that would give us improved security, give Europe an improved situation, start her back towards the economic rehabilitation that must come if European civilization is to live."

Mr. Vanderlip articulates a crucial phase of the whole business situation. For foreign trade to attain a stable basis on a large scale, efforts must be made to revive the purchasing power of foreign countries. On the solution of the question of reparations and the European financial problem inseparable from it, rests, to a large degree, the immediate future of world trade.

Also in the crucible of unsettled economic problems, which too will affect the trend of trade and finance, are such matters as railroad wages, the lack of an equilibrium of prices, depreciated currencies, inadequate rural credits, and unemployment.

View Full Issue

View Full Issue

Subscribers have complete access to the archive.

Sign In Not a Subscriber?Join Now