Sign In to Your Account

Subscribers have complete access to the archive.

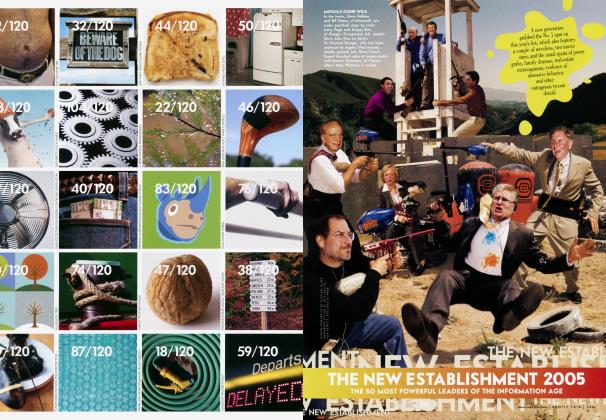

Sign In Not a Subscriber?Join NowVANITY FAIR'S Fourth Annual 1998 NEW ESTABLISHMENT 50

The Top 50 Leaders of the Information Age

The New Establishment

No. 1 Bill GATES

CHAIRMAN AND C.E.O., MICROSOFT CORPORATION

LAST YEAR'S RANKING:

DEALS AND DEEDS: Microsoft's market capitalization surpassed $300 billion this year, making it a close second to General Electric as the most valuable corporation on earth. Gates's personal fortune topped $60 billion, more than the gross domestic product of Kuwait, and more than the combined wealth of the 106 million Americans who are on the lower rungs of the income scale. No wonder Gates, 42, has taken on the status of a statesman: when a London paper ran a photo of Bill Clinton driving Gates in a golf cart, some sniped, "The most powerful man in the world—and his driver."

Gates looked at investing in debt-ridden Tele-Communications Inc., as he had invested in Comcast, but TCI's John Malone picked Sun over Microsoft to supply software for his company's cable boxes, and other high-tech giants followed Malone's lead. That's the least of Gates's problems, though, what with trustbusters at the Justice Department, at the European Union, and in Japan all pursuing their own investigations. Gates's second annual C.E.O. Summit, held in Seattle, was marred when his guests impolitely subjected him to a barrage of anti-trust questions. In March, it was the Senate Judiciary Committee's turn to interrogate him, though Gates's answers were inaccurate and misleading, according to The American Lawyer. Even the little guys are ganging up on Gates: Microsoft was sued by temp workers (it employs thousands) claiming as "permatemps" they deserved certain benefits. The daughter of Gates's P.R. mastermind co-authored an inside account of Microsoft called Barbarians Led by Bill Gates. Windows 98 crashed during his demo at the spring Comdex convention in Chicago. And when Gates moved into his house (valued at $53 million), after seven years of construction, there were glitches in the P.C.-based system that controls the lighting and music.

EVERYONE'S SAYING: The photo op of the year was the pie in the face at the Davos summit for world leaders in February. In keeping with his Wasp upbringing, Gates dismissed the incident with nonchalance and wit, saying he only wished the pie had tasted better. Back in the States, Gates received death threats from a 21-year-old Chicago man, who tried to extort $5 million to start a nightclub. (He was caught and convicted.) It's enough to make you feel a tinge of sympathy for the fellow, even if he did try to rehabilitate his image by showing Barbara Walters how he sings "Twinkle, Twinkle, Little Star" to his baby daughter. Still, there's wariness in Cyberville about Gates's halfhearted attempts to humanize himself. A popular rumor on the Internet claims that Gates staged the pie incident as a way of gaining sympathy.

WOULD YOU BELIEVE: PC Week's, private party at the Comdex trade show in Las Vegas last fall drew the likes of P.C. mogul Michael Dell, Compaq's Eckhard Pfeiffer, and Microsoft number two Steve Ballmer. Gates appeared with a very sexy young woman. As they danced together sensually on the stage at the Harley-Davidson Cafe, the crowd began chanting, "Bill! Bill! Bill!"

THE YEAR AHEAD: *

No. 2 Ruper MURDOCH

CHAIRMAN AND C.E.O., NEWS CORPORATION LIMITED

LAST YEAR'S RANKING: 2

DEALS AND DEEDS: It was a winning season for Murdoch, especially in L.A.: He ruled Hollywood with $ 1.8-billion-plus in worldwide Titanic box-office receipts (though the film was a co-production with Paramount), and the Fox network continued its hold over the coveted 18to-49-year-old audience. For his sports empire, he acquired the Dodgers for a reported $311 million—the most ever paid for a professional sports team. (During his new team's home opener in April, Murdoch asked to have the term "double play" explained to him.) On the downside, Murdoch failed with Fox's first bigbudget animated film, Anastasia, and was jeered when his HarperCollins publishing unit killed former Hong Kong governor Christopher Patten's memoir, East and West. (Not one of Murdoch's newspapers covered the story the day it broke.)

Murdoch's interest in satellites is beginning to pay off in the U.S.: in a complicated deal with John Malone's new United Video Satellite Group, he sold TV Guide for $2 billion, including a 40 percent stake in the venture. One of the most prominent media investors around, Saudi prince Al-Waleed bin Talal, must have been heartened by the move. In November 1997, he quietly paid $400 million for 5 percent of News Corp. stock. AlWaleed's interest wasn't enough to lift the company's lagging stock price, however. And, in an attempt to boost the value of News Corp.'s shares (and to address the company's $8 billion debt), Murdoch is merging his American film, TV, and sports businesses into a new entity called the Fox Group and is selling up to 20 percent in a public offering.

Murdoch, who is 67 and worth $6 billion, could be expected to take up golf. Instead, he is eyeing the Russian, Italian, and German TV markets (his newspapers account for 40 percent of all newspaper sales in the U.K.). This year he grew very chummy with L.A.'s Republican mayor, Richard Riordan, and continued his habit of generously supporting G.O.R candidates—his deep pockets have likely helped Fox TV avoid the wrath of the religious right.

EVERYONE'S SAYING: Analysts insist that News Corp. will be unaffected by the impending divorce of Murdoch and his wife, Anna. Under California law, the future exMrs. Murdoch could be entitled to half of any assets accumulated during the couple's 31-year marriage. Murdoch will remain chairman of the board, and his plan to gradually relinquish News Corp. stewardship to his three children is apparently unchanged. Last year Murdoch announced that his tattooed oldest son, Lachlan, 27, was first in line, though News Corp. also employs younger brother James, 25, and older sister Elisabeth, 30. On the other hand, Anna Murdoch also has a seat on the News Corp. board. If she keeps it, board meetings may make for interesting entertainment themselves.

WOULD YOU BELIEVE: Murdoch is probably the only mogul of his stature to be an actual wanted man. A warrant for his arrest was issued in New Delhi in July, after Murdoch failed to appear in an Indian court to face charges that his Star TV broadcasts material deemed "vulgar and obscene." Is there anyone the thick-skinned Murdoch fears? "Everybody in the communications business is paranoid of Microsoft," he said last year, "including me." THE YEAR AHEAD:

No. 3 Michael EISNER

CHAIRMAN AND C E O., THE WALT DISNEY COMPANY

LAST YEAR'S RANKING: 4

DEALS AND DEEDS: Disney stock has been more beauty than beast, and the company raked in $22.5 billion in sales last year (in corttrast to $ 13 billion each for Viacom and Time Warner), but third-quarter earnings were disappointing. THETEXT moderate success of Mulan and Armageddon couldn't make up for bombs such as Kundun and Krippendorf's Tribe. Even the Christian right's continuing boycott of Disney for championing Ellen could not get viewers interested enough to tune in to ABC; the network suffered a 9 percent ratings decline this season—the biggest drop of any of the major TV networks. Programming executives say ABC has a few decent shows scheduled for the fall, but when one of the pilots creating the most buzz is a remake of Fantasy Island, one has to wonder. Sundayand Monday-night football coverage is secured, but Disney had to cough up $9.2 billion for ABC and ESPN to get it.

THETEXT CONTINUED ON PAGE 183

NEW ESTABLISHMENT PORTRAIT OVERLEAF

FOR PHOTO INFORMATION THROUGHOUT, SEE CREDITS PAGE

Greetings from Sun Valley, 1998

CONTINUED FROM PAGE 174

Over in Theme Park Land, the $800 million Animal Kingdom in Orlando, Florida (it has 1,000 live animals, is five times the size of Disneyland, and is the most expensive theme park ever), opened to mostly rave reviews—and some outrage, stemming from the pre-opening deaths of rhinos, cheetahs, and otters. And in the Magic Kingdom's ocean-liner division, the launch of the first of two extravagant new cruise ships had to be delayed—primarily because of Disney's legendary perfectionism—to late July. The Italian shipbuilders refer to the two liners, the Disney Magic and the Disney Wonder, as the "Disney Tragic" and the "Disney Blunder." (They cost $350 million apiece.) In its undisputed triumph of the year, Disney successfully conquered Broadway: The Lion King won six Tony Awards, including that for best new musical.

EVERYONE'S SAYING: That the mice are jumping ship in alarming numbers, renewing speculation about Eisner's willingness to groom a successor. (But why think about stepping down just when the job is getting fun? Now that the suit brought by Jeffrey Katzenberg has been settled, Eisner's long-awaited memoir will be published by Random House this fall: it was delayed after Katzenberg's lawyers subpoenaed material from it which allegedly strengthened his claims. And Eisner collected $565 million in one day last December—the biggest executive payday ever—when he cashed in 7.3 million shares of Disney stock. He is now worth roughly $1 billion.) This year's top defections included Geraldine Laybourne, head of the Disney/ABC Cable Networks; Lawrence Murphy, head of strategic planning; Steven Burke, president of Disney's ABC Broadcasting division; and C.F.O. Richard Nanula. On the bright side, the exodus has spurred the 56-yearold Eisner to heal old wounds: at this year's Sun Valley retreat, Eisner and Michael Ovitz were spotted shaking hands for the first time since Ovitz was ousted last year from his shortlived reign as Disney president.

WOULD YOU BELIEVE: Eisner, a big Internet fan, likes to go into Christian-right chat rooms under an alias "and engage people in dialogue on various issues, and especially about their feelings for Disney," says a top staff member. The executive doesn't know Eisner's pseudonym, though. "It's probably not Titan or Mogul," she says. "Satan, maybe?"

THE YEAR AHEAD:

No. 4 Sumner REDSTOE

CHAIRMAN AND C.E.O.. VIACOM INC.

LAST YEAR'S RANKING: 12

DEALS AND DEEDS: A man who, one year ago, was written off as too old and out of touch to lead his giant entertainment company out of

overleveraged limbo is looking as limber as the dancing baby in the Blockbuster ads. Redstone, 75, was irked, though not surprised, by the fickleness of the public. "But I've got to not be distracted by short-term naysayers," he says, referring to the troubled months when Viacom's stock languished in the 30s, a victim of ongoing problems with the underperforming and overpriced Blockbuster unit (not to mention the $10 billion debt incurred by the purchase of Paramount in 1994). Today the stock is at around 60 and his net worth has doubled this year to $6 billion. The company's rebound can be attributed in part to Redstone's replacement of Blockbuster chairman Bill Fields with former Taco Bell C.E.O. John Antioco. Redstone and Antioco persuaded the studios to share the revenues and thfe risk, giving Blockbuster the tapes for next to nothing and getting a share of the take. "The first studio [to come on board] was Disney," says Redstone. "Once we convinced Eisner—everyone knows how tough he is—other studios followed." On the broadcast side, MTV Networks outshone all others, contributing 32 percent of Viacom's 1997 cash flow, while UPN expanded programming to five nights this fall. Paramount (thanks to Jonathan Dolgen and Sherry Lansing) has also had quite a run with The Truman Show and Saving Private Ryan. Redstone would dump UPN in a second if, as rumors suggested, he could trade up for NBC (though Redstone denies he's thinking about selling UPN). Could he afford it? Very possibly. Paramount had to share the wealth with Twentieth Century Fox, its partner in Titanic, but its profits of an estimated $275 million have helped the company get ahead of its own goals in paring down debt. In 1997, Redstone predicted Viacom's debt would be $6 billion to $8 billion by 1999. When the company completes its $4.6 billion sale of all but the consumer division of Simon & Schuster, the debt will be reduced by half. No one stands to benefit more than Redstone himself: he controls 67 percent of Viacom's shares.

EVERYONE'S SAYING: This rapid response to being overleveraged is in keeping with Redstone's well-earned reputation for being something of a skinflint. Upon hearing that James "King of the World" Cameron had reportedly requested $100 million for his work on Titanic, Redstone is said to have yelled, "I can't believe it! Of course we will pay him what is fair, but not what is obscene."

WOULD YOU BELIEVE: At this year's dinner of the National Conference of Christians and Jews, where he was honored with a humanitarian award, Redstone requested that Barry Diller, who battled him for ownership of Paramount in 1994, be the award presenter. Attempting introductory praise, Diller said, "What's one little billion-dollar dispute?" Redstone, while accepting his plaque, shot back that he would have preferred "an envelope with the $2 billion you cost me in the Paramount acquisition."

THE YEAR AHEAD: 4

No. 5 Ted TURNIR

VICE-CHAIRMAN, TIME WARNER INC.

LAST YEAR'S RANKING: 6

DEALS AND DEEDS: In the past year America's largest individual landowner (1.3 million acres) made the most generous single philanthropic pledge in history: $ 1 billion to United Nations programs over 10 years. Fifty-nine-year-old Turner, who is worth $5.6 billion, could well afford the grand gesture, since Time Warner's stock price has been buoyed by his cable businesses—and by Wall Street's faith in the Mouth of the South. Investors trust Ted more than his co-conspirator, Jerry Levin. Turner may be the nominal number two, but he's not afraid of his aloof partner in the executive suite: he voted down Levin's plan to sell Court TV. Over at Turner's beloved CNN, it was a particularly black year: ratings were down, and CNN's NewsStand, the network's hugely hyped coventure with Time Inc., goofed big-time. Overzealous reporting led to one of the great journalism snafus in recent decades: an allegedly fallacious report that U.S. troops used sarin gas in Laos. Turner called the fiasco "the most horrible nightmare that I ever lived through," including, he said, "the death of my father."

EVERYONE'S SAYING: Turner's waiting in the wings to swoop down upon Bob Daly and Terry Semel's entertainment empire. In his off-hours, Turner carefully tends to his feud with arch-rival Rupert Murdoch. Last March, he voted against Murdoch's successful purchase of the Dodgers at the Major League Baseball owners' meeting, and commenting on Murdoch's split with his wife, Anna, the thrice-married Turner told Larry King, "Sixtyseven is no time to be dating, I'll tell you."

WOULD YOU BELIEVE: Turner has taken a keen interest in a dinosaur movie that is in the early stages of development at Time Warner's New Line. When it came time to name the film, Turner said in his southern drawl, ^ "How 'bout DinosaurT' When his colleagues said no, he came back with "How 'bout Dinosaurs'.?" They told him it was too literal. Turner said, "Well, what's wrong with that? I had this idea once for a cable news network and you know what I named it?"

THE YEAR AHEAD: 4

No. 6 Gerald LEVIN

CHAIRMAN AND C.E.O., TIME WARNER INC.

LAST YEAR'S RANKING: 3

DEALS AND DEEDS: After buying Turner Broadcasting in October 1996, he proudly announced that his empire was now "strategically complete," which might explain why Levin has done little else of note in the past year. He tried to sell Court TV to the Discovery Channel for $350 million, which is chump change when you run a $25 billion media-entertainment conglomerate. But Levin's ornery number two, Ted Turner, blocked the proposed sale, afraid that the TV-verite news channel would compete with CNN. Meanwhile, Levin watched haplessly as Time Warner's film division, which accounts for one-quarter of its overall revenues, turned out a string of flops. The summer brought relief with a record opening for Lethal Weapon 4, but because the principals in the movie make so much front-end money, the studio stands to earn only a small profit. Good thing Paul Allen, Bill Gates, and John Malone have been driving up cable stocks: Time Warner (the second-largest U.S. cable provider) has finally seen its stock rise—from the dismal mid30s in 1996 to the more respectable high 80s.

EVERYONE'S SAYING: Now that Disney has paid $900 million for eventual control of Infoseek, a popular portal to the Web, the 59year-old Levin will parry with his own big "electronic commerce" venture. He's thought to be planning a service that will enable consumers to download movies and music over the Internet, and also order the kind of kitschy trademark merchandise (Bugs Bunny shirts, Daffy Duck hats) sold by the Warner Bros, studio stores. Still, his push for interactive cable TV in Orlando, Florida, was a comical failure, and even his publishing boss, Don Logan, has called the company's Pathfinder Web site a "black hole."

WOULD YOU BELIEVE: Levin grew up in a devout Philadelphia Jewish household and was an aspiring rabbi who actually conducted synagogue services before he was bar mitzvahed. THE YEAR AHEAD: *

No. 7 Steve CASE

CHAIRMAN AND C E O., AMERICA ONLINE

LAST YEAR'S RANKING: 8

DEALS AND DEEDS: Well over 47 million Americans will be on-line by the end of this year—19 million more than last year. With more than half of the on-line market subscribing to America Online, this means one thing for Case: redemption. Creator of the strongest brand on the Internet, 40-year-old Case has finally turned his interactive village into a bona fide mass medium. AOL's stock has responded accordingly, rising a jawdropping 350 percent in the last year. Wall Street praises Case's deputy, Bob Pittman; for finally capitalizing on AOL's most compelling asset: its 15 million members (more than the circulation of the top 15 newspapers in the country combined). Thanks to Pittman's aggressively redesigned marketing strategy, AOL now operates like a cable network, collecting revenue from both subscribers and advertisers eager to reach AOL's captive and affluent audience (66 percent of its members live in households earning more than $50,000). With media outlets such as CBS SportsLine, Bloomberg, and Slate now paying for the privilege of appearing as AOL content, revenues reached $2.6 billion this year. In June, AT&T's C. Michael Armstrong tried to acquire AOL, offering considerably more than the company's imposing $20billion-plus market capitalization; Case rebuffed him. In the past year, AOL has neutralized its competitors, acquiring the highbrow service CompuServe and partnering with the struggling Netscape. Meanwhile, federal judges struck down White House aide Sidney Blumenthal's demand that AOL be held responsible for libelous content distributed in a Matt Drudge column.

EVERYONE'S SAYING: The upside is that everybody wants to be AOL. The downside: everybody is now a competitor of AOL's, including telecoms, media conglomerates, cable providers, and mere tech companies. (Bill Gates has said not buying AOL is one of his greatest regrets.) In the last year, Disney and NBC have purchased search engines that Disney, for one, hopes to build into an AOL-like community. Still, Case's service is not universally adored. Anti-AOL venom abounds (try the Web site aolsucks.org). The service is derided as "the Internet on training wheels" and a tool for "point-and-click morons." An "aol.com" E-mail address may lack the cachet of a 212 or 310 area code, but Case isn't relying on being the hippest joint in townjust the easiest. His next challenge? His older brother, Dan, who is sometimes called "Upper Case" (he's the worldwide C.E.O. of the investment bank Hambrecht & Quist), wonders if "Lower Case" Steve can function in noncrisis mode. "They'll have to deal with a new challenge, which is being a leader, not the underdog," he says. Case and company are perhaps anticipating the need for future damage control: AOL tried to lure departing White House spokesman Michael McCurry over to its Dulles, Virginia, headquarters. McCurry did not take the job.

WOULD YOU BELIEVE: Case's personal life reached new highs along with his stock price. In July he married Jean Villanueva, AOL's former communications chief, in a ceremony performed by Case's friend the Reverend Billy Graham (they met on-line). Case and Villanueva's interoffice romance caused strain on their prior marriages—and anxiety within AOL's board. (Villanueva left the company in 1996.) Despite Case's affinity for events connected and shared, the ceremony was distinctly private: only their five children attended. Family members were FedEx'd photos and wedding cake the following day.

THE YEAR AHEAD: 4

No. 8 Barry DILLER

CHAIRMAN AND C.E.O., USA NETWORKS, INC

LAST YEAR'S RANKING: 5

DEALS AND DEEDS: Last October, Diller, 56, astonished everyone by announcing the purchase of most of Universal's storied television division along with the Universal-owned USA and Sci-Fi networks. The $4.1 billion deal instantly transformed him into a mega-mogul with ownership of 16 TV stations plus cable operations that give him access to 73 percent of American homes. The value of Diller's company—formerly called HSN and renamed USA Networks last February—has increased astronomically over the last two and a half years, from $235 million to $9 billion. But how to program his new holdings? When Diller looks at the TV industry, he sees corporate consolidation, uniformity, and Hollywood parochialism. "It all looks and talks and acts the same," he says. "They all do 'If it bleeds, it leads.' I thought, Wow, that's an opportunity." Diller has hired Stephen Chao—last seen exiting Fox after hiring a male stripper for a corporate meeting—to help inject fresh programming ideas into the USA Networks schedule. In at least one instance, Diller preferred convention over novelty: one of his first moves was to rap the knuckles of daytime schlock king Jerry Springer, whose show Diller inherited with his USA acquisition. Diller's decree to Springer: less raunch, less brawling, less perversity.

EVERYONE'S SAYING: Diller's reported (and denied) attempt to merge with NBC caused speculation that despite his unsuccessful runs at CBS and Paramount in the early 90s he still has his eye on a big fish. But he says he prefers being the underdog. With his ownership of Ticketmaster, and his experience with the shopping networks QVC and HSN, Diller is considered uniquely positioned to capitalize on the electronic-retailing craze. (His August acquisition of the on-line arts-and-entertainment guide CitySearch, which will be merged with his Ticketmaster Online service, makes him a player along with America Online and Microsoft in the Internet city-guide business.) And he is one of the few media barons who can handle finance, technology, and programming. As for movies, he believes that executives have abdicated authority over movie production to the talent. In other endeavors, Diller is a backer of Brill's Content magazine—perhaps an odd source of funding for a publication striving to objectively critique the media.

WOULD YOU BELIEVE: Diller is one of the most respected members of the New Establishment and one of the most loyal. Even his legendary temper is in abatement, and these days he works off stress by cycling. This year, Diller, Michael Eisner, and a dozen others maintained their tradition of a summer cycling excursion with a trip to the San Juan Islands. THE YEAR AHEAD: 4

No. 9 Steven SPIELBERG

PARTNER. DREAMWORKS SKG

LAST YEAR'S RANKING: 8

DEALS AND DEEDS: The year opened with a shaky first act, but the third act was a doozy. Amistad, last December's highly anticipated slave-revolt picture, was, by anyone's standards, a disappointment. It grossed $44 million, reviews were lukewarm, and the DreamWorks triumvirate was forced to defend itself against charges that it had plagiarized from a book by novelist Barbara Chase-Riboud. In other words, it was a perfect time to trot out Tom Hanks and Matt Damon for Spielberg's stunning World War II drama Saving Private Ryan, a joint Dream Works/Paramount production which may gross $200 million. Sticking with another sure bet, Spielberg, 50, is producing the third Jurassic Park installment.

EVERYONE'S SAYING: That, if the current Hollywood conspiracy theory is to be believed, Spielberg will be working outside the DreamWorks fold this year. Aside from the Jurassic Park project, he is developing a film, Memoirs of a Geisha, with Columbia Pictures. Spielberg has a problem with the live-action division, which he oversees. Though Spielberg makes all the big decisions, the division is run by Walter Parkes and his wife, Laurie MacDonald, and Parkes has a tendency to micromanage and interfere with talent. Nothing ever gets out of development. In some Hollywood circles the motto of the live-action department is said to be "Get ready, aim, aim."

WOULD YOU BELIEVE: This has been one of the most turbulent years of Spielberg's life: Amistad fizzled; until the one-two punch of Deep Impact and Saving Private Ryan, the press continued to scoff at DreamWorks' early track record; and he was forced to sit in a courtroom with the deeply troubled man who was later convicted of stalking him. At one point, the stress was so intense that Spielberg retreated to Quelle Barn, his Charles Gwathmey-designed home in East Hampton, where he later devoted himself to preparations for Bill and Hillary Clinton's weekend stay in early August, which fell conveniently after the blockbuster premiere of Saving Private Ryan and before Monica Lewinsky's grand-jury testimony.

THE YEAR AHEAD: 4

No. 10 Andrew GROVE

CHAIRMAN, INTEL CORPORATION

LAST YEAR'S RANKING: 5

DEALS AND DEEDS: Although he continues to serve as Intel's chairman and its link to the mogul club, Grove has ceded the role of C.E.O. to perennial number two Craig Barrett—just in time to let Barrett take some of the heat for the company's day-to-day troubles. Profits have been off for several quarters, thanks to Asia's financial malaise, a glutted microprocessor inventory in the U.S., and strong demand for $l,000-and-under P.C.'s, where Intel's profit margin is tiny. In the first quarter, earnings dipped 36 percent, and in June the F.T.C. sued Intel for anti-trust violations, accusing the company of withholding crucial information about its microprocessors from computer makers. But Grove has not let the dispute devolve into a spitting match. "You don't see the same harsh responses from Intel that you saw at Microsoft," says one executive at a technology-consulting firm. "Intel, unlike Microsoft, is basically run by grown-ups."

EVERYONE'S SAYING: While Intel made news with its new-generation, superfast Merced microprocessor, the state-of-the-art chip is not going to be a big factor in the company's bottom line for a few more years. The real challenge for Intel and Grove right now is to make consumers want to upgrade even though the average person's P.C. is already faster and more powerful than anything he really needs.

WOULD YOU BELIEVE: Grove, 62, is perturbed by reports that his famously hot Hungarian temper is cooling. Hapless employees have incurred his wrath with such cardinal sins as lateness. They still describe the scariness of the patented Grove Glare. "If I am getting more patient, I don't like what's causing it, which is age," Grove says.

THE YEAR AHEAD: -►

No. 11 Louis GERSTNER

CHAIRMAN AND C.E.O.. IBM CORPORATION

LAST YEAR'S RANKING:

DEALS AND DEEDS: IBM's stock chart under Gerstner's reign has looked like a straight upward line. Last November, with IBM's market capitalization up almost $70 billion in his five-year tenure, he said that his job was only half done, and pledged to stay another five years. He had plenty of encouragement to stick around: last year the board gave him a huge stock grant that boosted his annual pay to $91.5 million, making him the third-best-paid executive of the year. IBM has $5.5 billion in cash. And that's after Gerstner set aside $3.5 billion for Big Blue to buy back its own stock—a ploy that lifted the market price.

EVERYONE'S SAYING: Gerstner, 56, has been a shock to the sleepy IBM culture, often for the better. For instance, he banned managers from using visual aids in their presentations after finding that this time-consuming pursuit was often the be-all and end-all of his company's insular executive life. But given his success, why does Gerstner have to be so incredibly touchy? He canceled his appearance at PC Expo because he hated a cover story about him in Fortune magazine, a sponsor of the event, even though the article was generally laudatory. And despite IBM's considerable power, Gerstner hasn't been very supportive of Netscape, one of his supposed allies in Silicon Valley s anti-Microsoft junta: in the software packages it resells to major corporate clients, IBM rebuffed Netscape by choosing the Apache server program.

WOULD YOU BELIEVE: Gerstner is such a tough-guy workaholic that he found a way to continue working while recovering from surgery for a detached retina. Even if he couldn't see, he could still obsessively work the phones from his home in Greenwich, Connecticut's Belle Haven section, which is guarded by a private security force.

THE YEAR AHEAD: -►

No. 12 C. Michael ARMSTRONG

CHAIRMAN AND C.E.O., AT&T CORPORATION

LAST YEAR'S RANKING: *IONE

DEALS AND DEEDS: C. Michael Armstrong would seem dynamic and decisive even if the man he replaced, Bob Allen, hadn't been one of the most somnolent bosses in America. Last summer, Armstrong, 59, stunned Wall Street with three enormous deals. First, America Online rebuffed his bold $25 billion takeover bid. Then TCI's John Malone agreed to merge in a dizzying $48 billion transaction. Armstrong's vision is for TCI's cable network to pump phone, Internet, and television into millions of American households using one wire, but to do it he's going to have to spend a minimum of $10 billion upgrading TCI's infrastructure from one-way video lines to a two-way delivery system capable of sending voice, data, and video. Finally, Armstrong moved aggressively to shore up AT&T's weak international business, striking a deal with British Telecom to create a $3 billion joint venture that will supply voice, data, and Internet services to corporate customers around the globe.

EVERYONE'S SAYING: Armstrong, the former head of G.M.'s Hughes Electronics division, looks shrewd for turning down the numbertwo spot at AT&T two years ago; now he has the job he really wanted. A former collegefootball player who is also skilled on the tennis court, he often shows up at the office in a sweater and casual slacks and urges his employees to call him Mike. But his staff finds him intimidating; meetings can last up to six hours, with Armstrong rigorously crossexamining his executives.

WOULD YOU BELIEVE: Armstrong loves his two Harley-Davidsons so much that he bought shares in the company. One of his big thrills was biking across Minnesota and Wisconsin with a bunch of Harley executives.

THE YEAR AHEAD: *

No. 13 David GEFFEN

PARTNER, DREAMWORKS SKG

LAST YEAR'S RANKING: 13 DEALS AND DEEDS: How does 55-year-old Geffen spend his time? "Being rich," says a source. "It's time-consuming being a billionaire. You have to move money from over there to over here." "He knows everybody in the whole world, and they all seem to owe him on some level," says Terry Press, the DreamWorks marketing head. Geffen successfully conducted difficult negotiations for the services of Whitney Houston and Mariah Carey for the Prince of Egypt soundtrack, but, so far, the DreamWorks music division, which Geffen oversees, has woefully underperformed, although this year it appears to be gathering a head of steam. (Geffen Records, established in 1980, lost money for five years before it became a success.) "He's done it over and over again, and time is on his side," says one observer. "Sooner or later, he'll have a big hit. He's brilliant at positioning himself behind the hits and making the failures go away." DreamWorks' slow start does not seem to have diminished the enthusiasm of the studio's backers. When South Korea's Cheil Foods & Chemicals pulled out because the government blocked the outflow of capital, Paul Allen snapped up much of the stock, bringing his total investment to $660 million, or 24 percent, exceeding the partners' shares of 22 percent each.

EVERYONE'S SAYING: When rumors start to fly—like the one that has DreamWorks buying, or selling itself to, Universal—Geffen, whom Edgar Bronfman has described as his "guardian angel," is always at the epicenter. Says one source, "Geffen's long-term strategy is a merger of DreamWorks and Universal. He's joked about it, and as [Freud said], there are no jokes." Responds Geffen, "There's not an iota of truth in that—you have my word of honor on that."

WOULD YOU BELIEVE: For all his money, Geffen prefers a relatively modest existence: there's the Fifth Avenue apartment designed by Charles Gwathmey, the summer house on Fire Island, the beach house in Malibu, and the former Jack Warner estate in Beverly Hills. Each one is a miracle of tasteful understatement and unpretentiousness, in keeping with the Geffen T-shirt-and-jeans style of inconspicuous consumption. So much so that when President Clinton overnighted last November at Katzenberg's huge Malibu compound, he asked why it was so much nicer than Geffen's simple two-bedroom home down the Pacific Coast Highway.

THE YEAR AHEAD: *

No. 14 Steve JOBS

CO-FOUNDER AND INTERIM C.E.O.. APPLE COMPUTER, INC., AND CHAIRMAN AND C.E.O., PIXAR ANIMATION STUDIOS

LAST YEAR'S RANKING: 32

DEALS AND DEEDS: Similar to his pal Lawrence Ellison's earlier Hamlet-like wavering over whether to buy Apple, Jobs, 43, vacillated over whether he wanted to run it. He's been the "interim C.E.O." for such a long time, it's comical. Apple's sales remain depressingly weak ($7 billion last year, down from $11 billion in 1995), but Jobs wowed Wall Street by making a profit in three consecutive quarters after a legacy of huge losses under his predecessors. The improved results come from cost-cutting and higher profit margins on the new line of high-end, superfast Power Macintosh G3 machines. Under Jobs's "interim" leadership, the stock price has tripled.

In August, Jobs launched the iMac, a sexy, translucent Macintosh that rivals the Volkswagen Beetle as the year's hottest product design (there were 150,000 advance orders). He killed the Newton, a handheld computer that had been hyped by former C.E.O. John Sculley (who ousted Jobs in 1985). Meanwhile, the stock price surged at Jobs's other company, Pixar; his 68 percent stake was once again worth more than $ 1 billion. In February he said that Pixar would do one animated feature a year, equaling the output of its partner Disney. Its new Film, A Bug's Life (with Kevin Spacey's voice), reportedly a stunning achievement, will arrive in theaters at Thanksgiving, a month after DreamWorks' competing Antz (with Woody Allen's voice).

EVERYONE'S SAYING: Jobs's temper is legendary, and he hasn't mellowed with age, or the birth in July of his fourth child. When a CNBC reporter asked why it was taking so long for Jobs to replace himself with a permanent C.E.O., Jobs stormed out of the interview. He always has to have things his own way, and he's very, very particular. According to a source, he's obsessive about having his wife, Laurene, prepare a certain vegetarian salad for him, down to the most minute details. When he took to occupying the handicapped space in Apple's crowded parking lot to protect his silver Mercedes, an employee put a sign on his car that said, PARK DIFFERENT (a play on Apple's "Think Different" advertisements).

WOULD YOU BELIEVE: Jobs says that Pixar began discussing A Bug's Life with Disney back when Jeffrey Katzenberg was still there. Jobs was furious when he heard that one of the first projects on the DreamWorks slate was an animated bug movie. Also: an unsung computer consultant named Michael Murdock repeatedly sent E-mail to Jobs, saying he'd like to be Apple's C.E.O. Jobs wrote back insincerely that Murdock could have the position. When Murdock told Jobs when he could start, Jobs threatened to have him arrested if he made trouble at the Apple campus.

THE YEAR AHEAD: 4

No. 15 Herbert A. ALLEN

PRESIDENT AND C.E.O.. ALLEN & COMPANY INCORPORATED

LAST YEAR'S RANKING: 14

DEALS AND DEEDS: Barry Diller and Edgar Bronfman Jr. may have dreamed up their brainbending USA Networks deal before calling Allen & Co., but the transformation of Diller into media mogul this year is, to a large degree, the end result of back-channeling by the ultimate consigliere. It was Allen and his sidekick Paul Gould who convinced Diller five years ago that the Home Shopping Network could be his vehicle for empire building; it was Allen who persuaded HSN's wary owner John Malone to let Diller drive. Diller needed capital to grow; Allen & Co. raised $100 million for him, in no small part because the firm (i.e., Herbert) took a huge position. Diller used the cash to get TV stations (Silver King), customers (Ticketmaster), and finally programming (USA Networks), with Allen & Co. advising him at every step. All this enriched Malone, whose real payday came when Gould midwifed AT&T's takeover of TCI to completion. And as HSN's stock went from $9 to $25, Allen & Co.'s stake grew, too. (Allen himself is worth $1.5 billion.) But you won't hear this from the laconic guy who runs the stubbornly small firm at the crossroads where media and high tech meet. "I feel sorry for you," the 58-year-old Allen tells a reporter. "I'm a really boring subject."

EVERYONE'S SAYING: It's true that Allen's Sun Valley gatherings are less a boys' camp than they used to be, that some of the boys are mad at one another, and that girls now come, too. (Among this summer's speakers: fashion designer Diane Von Furstenberg and Diane Sawyer, of ABC News's PrimeTime Live.) But business still gets done in the tall grass. Malone and AT&T's C. Michael Armstrong dominated the den chat by trying to explain the labyrinthine intricacies of their merger, apparently convincing major investors the move was shrewd.

WOULD YOU BELIEVE: According to one Sun Valley participant, Barry Diller talked to several investors about helping him buy NBC, but he was told to cool it by his pal and partner, Edgar Bronfman Jr., who still controls enough of USA Networks to sidetrack Diller, and whose $10.6 billion PolyGram purchase has given him quite enough debt to manage for now.

THE YEAR AHEAD: 4

No. 16 John MALONE

CHAIRMAN AND C.E.O., TELE COMMUNICATIONS INC.

LAST YEAR'S RANKING: 11

DEALS AND DEEDS: The master strategist of the cable industry has become the Obi-Wan Kenobi of the digital universe. After failing to merge TCI with Bell Atlantic in 1994, Malone remained determined to rule the information superhighway by marrying the Internet, video, and telephone capability on his cable system. Uniting forces with AT&T chief C. Michael Armstrong, Malone forged the deal of the decade—selling his cable giant to the phone company in an historic $48 billion mega-merger that will change the face of the industry. Once the mammoth transaction is finalized, AT&T will be able to begin offering local phone service over TCI's cable lines, which stretch into approximately 30 million homes. And Malone will be one step closer to making good on his promise that by 1999 TCI will offer the technological equivalent of instant gratification: an advanced set-top box that will deliver not only more than 100 channels but also immediate Internet access to everything from E-mail to on-line banking. In June, Malone's United Video Satellite Group snagged 44 percent of TV Guide from Rupert Murdoch as well as the right to create an over-the-air version of TV Guide, which will provide "content" for his Prevue Channel.

EVERYONE'S SAYING: The AT&T merger sets Malone up as "the single most influential man in the cable industry," according to Capital Research senior V.P. Gordon Crawford. Now that Malone is AT&T's largest individual shareholder (and earned a tidy $2 billion on the deal), the $150 million fee he wrangled early this year as part of the settlement of the legal dispute over the estate of TCI founder Bob Magness looks like pocket change. The AT&T deal also makes clear that Malone knew exactly what he was doing when he installed 50year-old Leo J. Hindery Jr. as his chief deputy at TCI last year to clean house and ready the company for sale. Malone is heading up Liberty Media, TCI's programming unit (which will be a division of AT&T), and he has much of his net worth tied up in Liberty, which has stakes in Time Warner, USA Networks, and Fox/Liberty Networks. Thanks to his shrewd deal-making, Malone is starting out with a huge war chest of an estimated $14 billion, which will make him an imposing force in the media business. Anyone who thinks he may be dialing back after the sale of his company is in for a surprise. "He will be the 800-pound gorilla on AT&T's board," predicted a fellow camper at Herb Allen's Sun Valley retreat after a meeting with Malone.

WOULD YOU BELIEVE: The flinty 56-year-old cable chieftain has been quoted recently as saying he has no idea what to do with all his money. Turns out the one thing he won't be doing is giving it to his kids. Malone has directed in his will that most of his stock go to the Malone Family Foundation, a charitable education fund. His main concern, he says, is that all that money might turn his offspring into "jet-setters."

THE YEAR AHEAD: *

No. 17 Oprah WINFREY

C.E.O., HARPO PRODUCTIONS

LAST YEAR'S RANKING: NONE DEALS AND DEEDS: Empress of Empathy and Everywoman extraordinaire; icon and sage of afternoon television; actress; producer; studio mogul; fitness guru; philanthropist; frequent maker of best-selling books; bane of the Texas beef barons: Oprah Winfrey, 44, keeps adding hats and enhancing her astonishing power and influence in America, especially over women. On its list of the 40 highest-paid entertainers, Forbes ranks Winfrey third (earning $201 million in 1996 and 1997, she's behind only Steven Spielberg and George Lucas). With a net worth of $650 million, she's poised to become America's first black billionaire.

While pretenders periodically rise up and flame out, and her own ratings have ebbed a bit, Winfrey's television program, now in its 13th season of syndication, remains strong—14 million Americans watch her daily—and more profitable than any of its competitors. In a field that's grown coarse and coarser—see Jerry Springer—she's defied the odds by going upscale. The New York Times Book Review wrote that her book club has sent "more people to bookstores than the morning news programs, the other daytime shows, the evening magazines, radio shows, print reviews and feature articles rolled into one." Her Harpo Productions has a six-TV-movie deal with ABC; this month she'll star in Harpo's own version of Beloved, based on Toni Morrison's 1987 novel.

EVERYONE'S SAYING: When Americans were polled last year on which celebrity they'd invest in, Winfrey won hands down. (Spielberg finished second.) And not only do they listen to Oprah—they believe her. The day after a guest on her program declared that hamburgers could be hazardous to one's health, cattle futures dropped 11 percent; shortly after that, the cattlemen unsuccessfully sued her.

WOULD YOU BELIEVE: Even on enemy turf in the Texas Panhandle, where about a third of American beef is produced, Winfrey's allure was extraordinary. As the cattlemen fought Winfrey in the courtroom, their wives fought for tickets to her shows; even 12-year-old Rachel Mullin, whose father represented the beef producers, skipped school to see her. THE YEAR AHEAD: 4

No. 18 Jack WELCH and Bob WRIGHT

CHAIRMAN AND C.E.O., GENERAL ELECTRIC; PRESIDENT AND C.E.O., NBC

LAST YEAR'S RANKING: WELCH. NONE; WRIGHT. 17

DEALS AND DEEDS: In an industry beset by massive viewer defection and flat advertising sales, even Welch and Wright could not dodge all the bullets. They lost their coveted sports franchise, the N.F.L., and their license to print money, Seinfeld. And the skyrocketing price of must-see TV (at $ 13 million an episode, E.R. will cost the network nearly $900 million over the next three years) began to pose such a threat to their future profits that they actively explored an alliance with another company or a spin-off of the toprated network. (Sumner Redstone and Barry Diller were among the rumored interested buyers.) The broadcast networks hit rock bottom when, for a single week in June, more viewers watched prime-time basic-cable programming than NBC, CBS, ABC, and Fox combined—the first such defection ever. NBC will be the only broadcast network to make money this year, but, in the face of an estimated $100 million drop in profits, Wright has instituted a brutal cost-cutting policy, cracking down on travel and expense accounts, overnight mail, overtime, and even expenditures on set design. NBC maintained its place as No. 1 in news, entertainment, sports, and cable, and it managed to sell more commercial time in advance for the 1998-99 primetime season than it had for 1997-98. The cable divisions, CNBC and MSNBC (a joint venture with Microsoft), dominated TV coverage of the Monica Lewinsky investigation, and experienced a spike in their ratings as a result (44 percent for MSNBC, and 31 percent for CNBC's prime time). With Olympic coverage already sewn up through 2008, Welch and Wright scored their biggest coup by snagging the TV rights to Titanic for 10 nights, beginning in the year 2000, for a paltry $30 million.

EVERYONE'S SAYING: The secret of NBC's astonishing success is the special relationship between the self-deprecating Bob Wright and his hypercompetitive boss, Jack Welch, perhaps the most revered C.E.O. in America. The 62-yearold Welch, it is expected, will retire at 65 in the year 2000. Wright, who is 55, is probably too old to succeed Welch as chairman of G.E., but Welch admires and respects his friend and protege. Welch's home fax spews out the overnight Nielsen ratings each morning, and it was he who had the final say in NBC's decision to get out of football. "We had football for 33 years," explains Wright. "We figured that somewhere in a new eight-year N.F.L. contract we were going to get whacked, and so we wisely passed." They may not have given up on it entirely—NBC and Turner Broadcasting are discussing the launch of their own, rival football league.

WOULD YOU BELIEVE: Despite undergoing triple-bypass surgery three years ago, Welch, who has a golf handicap of 3.8, beat Greg Norman, 69-70, last winter in a friendly match in Stuart, Florida. Wright gets his R&R building houses and sailing. During a trip on Johnny Carson's yacht, he was caught in an electrical storm off the west coast of Canada. The normally mild-mannered Wright recalls, "It was a high-adrenaline situation."

THE YEAR AHEAD: *

No. 19 Warren BUFFETT

CHAIRMAN AND C.E.O., BERKSHIRE HATHAWAY INC.

LAST YEAR'S RANKING: 16 DEALS AND DEEDS: Not since William Jennings Bryan a century ago, and the Hunt brothers more recently, has silver had as big a backer as Buffett. He surprised the commodities markets in February, when he revealed that he had spent $860 million buying up 129.7 million ounces of the metal (20 percent of the world's annual silver production). Buffett, 68, has been on something of a spending spree: In June he made his biggest deal in years when he acquired the giant reinsurance company General Re for $21.7 billion in stock. He bought Dairy Queen and Executive Jet, though he unloaded a supersized block of McDonald's Corp. shares and also sold a lot of US Airways stock. When Wells Fargo merged with Norwest bank in June, he made a tidy paper profit of $ 17 billion on Berkshire Hathaway's Wells Fargo holding, which helped bring his net worth to $33 billion—up $10 billion from last year.

EVERYONE'S SAYING: He may not be on the cutting edge, but he's honest about it. He told Berkshire Hathaway's shareholders at his annual meeting in Omaha last May that he didn't understand the Internet companies and would not recommend investing in them. Buffett, who has outperformed the S&P 500 Index in all but 3 of the past 32 years, may have to change his mind, though. Up to now, his shareholders have been mainly accommodating mom-and-pop individual investors, but Buffett's purchase of General Re has brought some new, heavyweight mutual funds into Berkshire Hathaway's fold.

WOULD YOU BELIEVE: He still lives apart from his wife, Susie, cohabiting with another woman in Omaha, in an arrangement that friends say is Susie's idea. She prefers living in San Francisco. But outside Omaha the two are never apart. At Sun Valley this year, Susie serenaded her husband's fellow moguls after dinner on the final night. When she was finished, Buffett grabbed the mike and serenaded her. "If you knew Susie like I know Susie," he sang, "oh, oh, oh what a gal." Between the Buffetts, says a friend, "it's puppy love."

THE YEAR AHEAD: 4

No. 20 Steve BALLMER

PRESIDENT, MICROSOFT CORPORATION

LAST YEAR'S RANKING: 20 DEALS AND DEEDS: Only in America can a person amass a $13 billion fortune while working at someone else's company. No one doubts Ballmer's value to Microsoft. He is the fiery motivator of a relentless sales force, and he's the muscle behind Microsoft's dealings with other companies. When the Justice Department filed suit, it was Ballmer, not Gates, who personally called the box-makers and pushed them to voice public support for Microsoft. In July, Gates officially upgraded Ballmer's title from executive V.P. to president, though Ballmer (who owns 4.9 percent of Microsoft) was already his anointed number two and the company's de facto day-today manager.

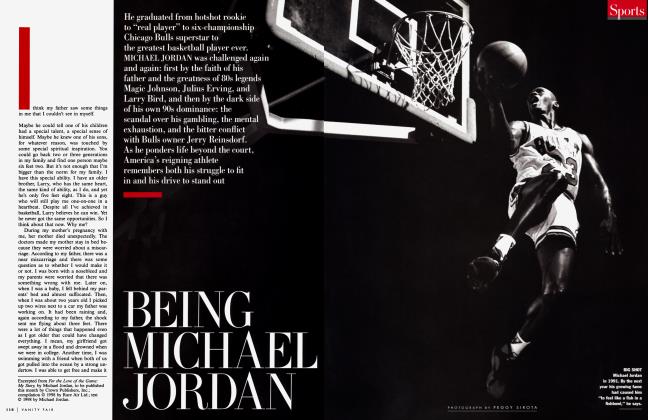

EVERYONE'S SAYING: The best business quote of last year came when Ballmer blurted "To heck with Janet Reno" during a conference with software vendors. So it's not hard to believe the ugly accusations made by rivals such as Netscape's Jim Barksdale, who claims that Ballmer once tried to lead customers in a chant of "Kill Netscape!" No wonder Ballmer is known as the Embalmer. David Dorman, the former C.E.O. of Pacific Bell, said that when some of the phone companies moved to adopt Netscape's browser instead of Microsoft's, Ballmer ranted like a lunatic. Given this strong-arm reputation, it's ironic that Ballmer's the point man in a campaign to make Microsoft's image less sharklike.

WOULD YOU BELIEVE: How much nervous energy does the 42-year-old Ballmer exude? He has been known to twirl a baseball bat to relieve his tension during meetings. (Once, he lost control and sent the bat flying toward a Microsoft colleague.) He also has inflicted cuts on his face while making wild hand gesticulations. How driven is Ballmer to build friendships and influence people? When he arrived at Harvard as an undergraduate, he memorized the names and faces of his approximately 1,000 classmates from the freshman "face book." He still aggressively researches names; these days, competitors say, he sends Christmas cards to their children— a gesture intended to warn rivals just how much he knows about them.

THE YEAR AHEAD: &

No. 21 Michael BLOOMBERG

FOUNDER. BLOOMBERG L.P.

LAST YEAR'S RANKING:

DEALS AND DEEDS: Bloomberg made accusations of foul play against his old-line British rivals at Reuters (who remain the greatest providers of financial news and information in the world). In February, Reuters executives confirmed that a New York grand jury was investigating whether they had hired a third party to steal data from Bloomberg's systems. The financial-data mogul, who employs 900 journalists, believes that information shouldn't be free, and he charges $20,000 a year for one of his terminals. The sleek "Bloomberg" box remains must-see TV for power players on the Street. "People ask for a Bloomberg instead of a raise or a company car," says a Wall Street analyst. Bloomberg, 56, is a billionaire who has been called "the only man on the planet who can make Donald Trump look like a shrinking violet." Even New York isn't big enough for his ego: he tried to make his mark on London society by hosting lavish dinner parties and donating £250,000 (more than $400,000) to the Serpentine Gallery in Hyde Park.

EVERYONE'S SAYING: The company that purports to be "on the edge of the edge" didn't report that the Dow had topped 9,000 until 9:47 a.m.—a full eight minutes after the event. "It was [screwed up] by some intern," says a former employee. "Mike hires a lot of kids and pays them virtually nothing." (Low starting wages notwithstanding, if you dare to quit Bloomberg's shop, you are banned from ever returning.) Analysts believe he'll flip his whole operation over to the Internet, which will save him lots of money (he says $70 million a year) because he won't have to run his own closed network. There are also rumors that Bloomberg is going to take his company public, and that he will run for mayor of New York City. He's dubious about the first, and others scoff at the second (he admits, "It would be a very expensive ego trip").

WOULD YOU BELIEVE: There are sharks in Bloomberg's sales department—real sharks, swimming in one of the dozen tanks of exotic marine life in the Park Avenue headquarters. Bloomberg may have an outsize ego, but he chooses to work in a cubicle in his news bull pen. Also, Bloomberg, the leading financial-tech innovator, doesn't use a computer to write—he composes longhand on yellow legal pads.

THE YEAR AHEAD: *

No. 22 Edgar BRONFMAN JR.

PRESIDENT AND C.E.O., THE SEAGRAM COMPANY LTD.

LAST YEAR'S RANKING: 9 DEALS AND DEEDS: When in trouble, make a deal. That seems to be Bronfman's M.O., and this year he did it—twice. First, he sold most of Universal television to mentor Barry Diller, keeping 45 percent for himself. In the process, Bronfman humiliated his C.E.O., Frank Biondi, by keeping him out of the loop with Diller. Then, when Bronfman ousted executive vice president Howard Weitzman, who functioned as C.O.O. Ron Meyer's consigliere, it appeared to be a vote of no confidence in the very lieutenants he had put in place. In May, Bronfman agreed to buy the Dutch record-and-movie giant PolyGram for $10.6 billion, instantly transforming Universal into a music behemoth. The PolyGram deal was widely applauded in financial circles because the profit margins in the music industry are much higher than those in the film business. Meantime, Universal has already made more than $ 1 billion in paper profits with Diller, and Seagram—a foreign company (Canadian) barred from owning more than 25 percent of a U.S. television station—has won valuable backdoor access through Diller. And, in a surprise reversal of what has been the custom, Universal's music and entertainment units outperformed Seagram's beverage division in the company's strong fourth quarter.

EVERYONE'S SAYING: Bronfman, 43, is supposedly "scared" of the movie business, with its unpredictability, humongous liabilities, and tiny profit margins. This may explain the recent exits of production head Marc Platt and the highly regarded marketing team of Buffy Shutt and Kathy Jones. Then again, could anyone have sold such a movie as Blues Brothers 20001 Bronfman, who doesn't understand why movies can't be peddled like booze, apparently believes Universal's pictures are so bad that good marketing is not enough. That said, this fall's lineup is seemingly impressive; it includes Meet Joe Black, Patch Adams, and Babe: Pig in the City.

WOULD YOU BELIEVE: Last spring Bronfman raised eyebrows by suggesting that ticket prices be calibrated in accordance with each film's budget. He blamed his problems on former MCA head Lew Wasserman, and called Hollywood a "dumb town." And it's been rumored that in a meeting in London with PolyGram executives after the purchase, he assured them that the integration of their company into his would be painless because the two companies have offices near each other in New York. Seagram executives routinely call him "Mr. Hollywood."

THE YEAR AHEAD: -►

No. 23 Nathan MYHRVOLD

CHIEF TECHNOLOGY OFFICER, MICROSOFT CORPORATION

LAST YEAR'S RANKING: 21

DEALS AND DEEDS: As one of Gates's top strategic advisers (and, following Ballmer's promotion, the only senior executive to report directly to him), Myhrvold found himself spending a lot of time in Washington, D.C., meeting with the Department of Justice. "I've been deposed more often than the Italian government," he says. Myhrvold, 39, likes to schmooze the moguls, but he stays close to the eggheads too. He has been enticing many of the world's top technical visionaries (600 so far) to give up their prestigious academic positions and corporate titles to join his research squad (which has a $2.7 billion budget). He can offer them the time and money they need to think great thoughts, plus an office literally down the hall from Bill Gates—oh, and did we mention a load of stock options too? Two of his missions: to create computers that can literally see, hear, and learn from experience, and to apply Microsoft's desktop technology to every consumer device imaginable, from cars to stuffed animals.

EVERYONE'S SAYING: Plenty of moguls get their picture on the cover of Fortune, but they usually don't have to pose in a propeller beanie, as Myhrvold did for a story on his research effort. Still, critics complain that, for all the brainpower Myhrvold is assembling, his group has yet to produce any big ideas. He nevertheless has become something of a celebrity: at the Davos, Switzerland, powerfest, the organizers put him on a panel with Elie Wiesel and Desmond Tutu.

WOULD YOU BELIEVE: When not fly-fishing in Mongolia, Myhrvold collects obsolete supercomputers, which he buys for scrapmetal prices. He doesn't actually use them— the electrical bill for a single machine would be $15,000 a month—but he's planning to put one in the living room of his new house (near Bill's on Lake Washington), which will reportedly have one of America's largest noncommercial kitchens.

THE YEAR AHEAD: *

No. 24 Lawrence ELLISON

CHAIRMAN AND C.E.O., ORACLE CORPORATION

LAST YEAR'S RANKING: 10 DEALS AND DEEDS: It was a scary year for Ellison's software company, which was hurt badly by the Asian upheaval. When Oracle reported lousy earnings last December, Wall Street traders overreacted and trashed the stock. The share price fell by 29 percent in one morning, giving Ellison a paper loss of more than $2 billion (he is believed to have lost more wealth in a single morning than any person in history). One-quarter of Oracle's shares changed hands that day, setting a NASDAQ record. By the spring, though, the shares rallied to their earlier levels, and Ellison's net worth hovers around $5.3 billion. Crisis averted, Ellison, 54, returned to Gates-bashing (in one company meeting he displayed a giant computer-generated image of Gates flashing Oracle employees the middle finger). Just before the Senate began its hearings on Microsoft, his company donated $200,000 worth of software to a campaign fund for Senate Democrats. In the corporate market, Ellison might as well try giving away network computers (his alternative to Microsoft-Intel P.C.'s), since customers aren't buying them—even at $500 to $600. Only 144,000 N.C.'s were sold last year (out of the 400,000 forecast), in contrast to 80 million RC.'s worldwide. One major blow to his plan: N.C.'s were supposed to be the low-cost alternative to P.C.'s, but P.C. prices dropped 40 percent in 1997. Ellison's Network Computer Inc. laid off 15 percent of its employees and fired its C.E.O.

EVERYONE'S SAYING: Though he seems to have re-engaged his professional commitments recently, Ellison is known to disappear for weeks or months as he indulges his playboy lifestyle—chasing women, flying fighter planes, lifting weights for hours on end, and taking long cruises to Fiji on his 192-foot yacht, the Sakura. Some insiders claim that his absences represent benign neglect of Oracle: when word gets around that he's haunting the hallways of his lavish emerald towers, executives dust off their resumes and sell off their stock. On a personal note, Ellison has been known to keep a roster of different chefs—each dedicated to cooking a particular type of food.

WOULD YOU BELIEVE: Ellison's romantic life has improved since Adelyn Lee, the employee who sued him for sexual harassment, was convicted of perjury and sent to prison. Since then he has maintained a longterm relationship with Melanie Craft, a twentysomething Oberlin-educated archaeologist who's the author of a romance novel called A Hard-Hearted Man. Plot summary: beautiful young archaeologist falls for rich, powerful older guy, tames him, gets him to marry her. Friends are already whispering that Melanie is Larry's "Fiancee" (which would place her in line to be wife number four), though nothing has been officially announced.

THE YEAR AHEAD: -►

No. 25 Gordon CRAWFORD

SENIOR VICE PRESIDENT, CAPITAL RESEARCH AND MANAGEMENT COMPANY

LAST YEAR'S RANKING: 26

DEALS AND DEEDS: Crawford, 51, is the big winner in the recent spate of telecommunications mergers and acquisitions. His cable group has tripled in the last year and a half. A quiet churchgoer, Crawford is also a visionary who has managed to win a lion's share of the global telecommunications pie: Capital Research and Management is the largest shareholder in John Malone's Liberty Media, the second-largest in Viacom (after Sumner Redstone), and the third-largest in Seagram, Disney, and Time Warner. Crawford is the Gary Cooper of the investment community—gentle, thoughtful, decent—and is friendly with the world's biggest moguls. "I spend a lot of my waking hours talking to Barry [Diller], John [Malone], Jerry [Levin], and Ted [Turner]," Crawford says. Although Crawford never takes his mind off his investments, he wields power congenially. "I'm a carrot guy 100 percent," he says. "I don't have a stick."

EVERYONE'S SAYING: That he is the single most influential investor in the entertainment business. "He's smart as a whip for someone who's an investor," says Turner. "He's graceful but Firm. If he doesn't like what's happening, he sure lets you know." WOULD YOU BELIEVE: Crawford was a classics major at Wesleyan. He got into business through a friend whose father had a seat on the National Stock Exchange; his First transaction was to co-invest $500 in a company that owned Cuban oil rights. His next transaction was in the Minnie Pearl chicken franchise; its stock rapidly rose from VA to 13.

THE YEAR AHEAD: *

No. 26 Jeff BEZOS

CHAIRMAN AND C.E.O., AMAZON.COM

LAST YEAR'S RANKING: NONE

DEALS AND DEEDS: With his on-line bookstore, Bezos is doing to the fearsome superstore chains exactly what they've done to the smaller independents: causing endless pain and anxiety. Seemingly out of nowhere, Amazon.com has become the nation's No. 3 bookseller, behind Barnes & Noble and Borders, and its stock is already worth more than theirs. (Bezos' 41 percent stake was recently worth $1.3 billion.) Amazon enjoys strong loyalty among its 3 million customers, most of whom are repeat buyers. Some half-million visitors go to Amazon every day, making it the most heavily trafficked retail site on the Web. Now that Bezos has so many fans, he's selling them music CDs too.

EVERYONE'S SAYING: The conventional wisdom used to be that the book behemoths would kill Bezos once they turned on their copycat Web sites. The reality is that he's beating them, and badly. In the first quarter of 1998, Amazon had sales of $87 million, whereas BarnesandNoble.com had a meager $9 million and lost so much money that it wiped out all the profits of the chain's hundreds of real-world superstores. Wall Street's short-sellers, who persisted in betting against Bezos, were also huge losers. Other investors love Bezos, 34, a razor-sharp Princeton Phi Beta Kappa who is as tightfisted as Bill Gates was in his younger days.

WOULD YOU BELIEVE: Bezos is the son of an Exxon executive, but as a teenager he spent his summers castrating cattle and fixing Caterpillar bulldozers at his grandfather's ranch in Texas. THE YEAR AHEAD: 4

No. 27 George LUCAS

FOUNDER, LUCASFILM AND INDUSTRIAL LIGHT & MAGIC

LAST YEAR'S RANKING: 22

DEALS AND DEEDS: Like a mighty tsunami, the first of George Lucas's three Star Wars "prequels" churns toward a Memorial Day 1999 opening, expected to be Hollywood's biggest ever. Or perhaps one should say Lucas's biggest ever, since Hollywood will get so little of the proceeds: Twentieth Century Fox will distribute Episode I for a fraction of its usual take. Lucas, whose 1997 earnings were second only to Steven Spielberg's in the entertainment industry, is worth $2 billion. "I'm not doing it for the money," Lucas says, though he stands to earn another billion from the trilogy, much of it from lucrative merchandising deals he struck in the last year with Hasbro, Inc., and Galoob Toys. The kick, he says, is in new technology that lets him make the on-screen fantasy more fantastic. About 80 percent of Episode I is photorealistic animation: Jurassic Park rather than Toy Story, to use his analogy. And this time the aliens are digital. "Yoda could only move a few feet as an actor in a rubber suit," Lucas says. Directing for the first time since Star Wars, Lucas is as unhappy as ever dealing with actors. But he says that even if digital humans are plausible by Episode II, he won't use them. Compared with animated characters, he says blithely, "humans are reasonably inexpensive."

EVERYONE'S SAYING: Lucas, 54, was reportedly furious at Peter Biskind's depiction of him in Easy Riders, Raging Bulls. Though he comes off far better than most of his harddrugging, ego-tripping peers in their formative days, the director and his loyal cast of hundreds at Skywalker Ranch and Industrial Light & Magic were shocked that Lucas's exwife, Marcia, shared the dirt on their marriage.

WOULD YOU BELIEVE: In the American Film Institute's recent list of the best 100 films ever, 2 were directed by Lucas: American Graffiti, which was made for $775,000 (and has grossed $140 million to date), and Star Wars, which was made for $10 million (and has grossed $774 million to date). Lucas, obviously proud of his blue-chip reputation in Hollywood, isn't above taking a swipe at those less accomplished. The posters for Episode I are rumored to mock Godzilla with a tag line that reads: "Plot does matter."

THE YEAR AHEAD: I

No. 28 Jeffrey KATZENBERG

PARTNER, DREAMWORKS SKG

LAST YEAR'S RANKING: 28

DEALS AND DEEDS: After observers wrote his plan off as an embarrassing disaster, apparently Katzenberg will finally succeed in parting the murky waters of the Playa Vista wetlands and pushing through the deal that will give his partner Steven Spielberg the biggest toy he's ever had: the first all-digital studio (designed by noted California architect Buzz Yudell). But this fall is the real moment of truth for Katzenberg, the company's animation czar, who bet a big chunk of the farm on two keenly anticipated features, The Prince of Egypt and Antz. Animated films represent 20 percent of DreamWorks' output, and they will be the cornerstone of the company's battle plan against its detested rival, Disney (which last November finally agreed to pay Katzenberg a reported $120 million of his $250 million lawsuit, in which he demanded royalties for films he had overseen before his departure). The Prince of Egypt is a spectacularlooking movie that brings to mind a David Lean epic, and Katzenberg is positioning it as an "event" picture rather than a cuddly family film. But the studio may be making the same mistake it made with Amistad, selling the picture like castor oil: "Watch it! It's good for you!"

EVERYONE'S SAYING: DreamWorks stands or falls on Spielberg. Some say his decision to direct his next movie, Memoirs of a Geisha, for Columbia must make his partners a bit nervous. Don't forget the ill will that existed between Katzenberg and Spielberg because of Barbara Chase-Riboud's $10 million plagiarism suit over Amistad. (The terms of the settlement were undisclosed, and in the end Chase-Riboud praised both Spielberg and the film.) Spielberg hated the bad press (Time called him "Steven Stealberg?") and wanted to settle, while Katzenberg decided to fight. Spielberg, it is said, blamed Katzenberg for the failure of the $75 million slavery picture. But David Geffen claims there is no feud: "Like I married Keanu Reeves at a Jewish ceremony at the beach. [Their differences were] as important as a baked potato we ate last week at Nibblers [a coffee shop in Beverly Hills]."

WOULD YOU BELIEVE: When Katzenberg hosted President Clinton at his Charles Gwathmey-designed beachfront Malibu home last November, the commander in chief kept the studio chief up way past his bedtime. Katzenberg, 47, has always been a very early riser, and when midnight rolled around, the president of the United States asked, "Well, whaddya wanna do now?" Katzenberg yawned (he gets up at five A.M.), but suggested, "Let's watch The Rainmaker It was two o'clock in the morning when the movie ended. Clinton asked, "Now whaddya wanna do?" Katzenberg (who had graciously stayed at his Beverly Hills home, allowing Clinton some rare time alone with daughter Chelsea) replied, "I want to drive home and go to bed."

THE YEAR AHEAD: *

No. 29 David FILO and Jerry YANG

LAST YEAR'S RANKING: NONE

CHIEF YAHOOS, YAHOO!

DEALS AND DEEDS: After the company's stock price increased 1,700 percent in just over two years ($10,000 invested a year ago would be worth $90,000 today), and its market value eclipsed $6 billion (higher than the Washington Post Company), the Yahoos (as Filo and Yang are known in Silicon Valley) became two of the world's youngest billionaires. Yang, 29, is the first Generation Xer to get a 10-figure net worth solely by working for it. Filo made his paper billion this year at 32. Their company is the envy of the Web, especially those babyboomers at Microsoft, Disney, AOL, and Netscape (the latter two each tried and failed to acquire Yahoo!). With 30 million visitors a month, Yahoo! easily takes the title of most-visited Internet portal (and lost only $18 million in the 12 months before July, against Lycos's $92 million and Excite's $28 million losses).

EVERYONE'S SAYING: What kind of market is this when a relatively small outfit (550 employees, $88 million in sales in the latest 12 months reported) that's hardly profitable is supposedly worth so many billions? To their credit, the Yahoos have maintained an appealing modesty and uncommon sanity all through the Wall Street madness. Rather than indulge in self-congratulation, Yang likes to say that they "got lucky," that the best thing the company has going for it is its goofy name, and that their smartest move was hiring a baby-boomer (Tim Koogle, 47) to run the place for them. Freed from that burden, Yang plays Mr. Outside, while Filo huddles by his screen, writing software. Filo's messy cubicle (decorations include a MICROSOFT MUST DIE sticker) evokes the duo's first office in a junk-strewn trailer on the Stanford campus, where they were doctoral students finding a creative way to avoid working on their theses. Since then, they've donated $2 million to their alma mater to endow a chair: the Yahoo! Professor of Engineering.

WOULD YOU BELIEVE: Even after becoming a millionaire, Filo continued to drive the ancient 1980 Datsun he had acquired while in high school in Louisiana. When it finally broke beyond repair, he sprang for a relatively luxurious set of wheels: an Acura Integra. For his part, Yang bought a $2 million house in the hills overlooking Silicon Valley. He married a Silicon Valley marketing consultant, planned their honeymoon over the Internet, and couldn't resist checking his E-mail on a laptop during the supposedly romantic trip—but only twice a day.

THE YEAR AHEAD: -►

No. 30 Paul ALLEN

CHAIRMAN, VULCAN NORTHWEST INC.

LAST YEAR'S RANKING: 25

DEALS AND DEEDS: After years of dabbling in seemingly every aspect of the digital convergence, Allen, 45, finally made a huge bet on a particular player—cable. He paid a total of $7.3 billion for two companies that he's combining into the nation's No. 7 cable system, with 2.4 million subscribers. Call it a nice little act of one-upmanship over his pal Bill Gates (though he and Gates are still on good terms), who had earlier paid $1 billion for a mere 11.5 percent stake in Comcast cable. Allen hopes to provide high-speed Internet access and interactive TV over the cable lines. "Finally I have some wires for my 'wired world,'" he said. In other deals, he became the biggest shareholder in DreamWorks, with 24 percent, compared with 22 percent each for the founders, after he bought shares from a Korean food company. He traded his $ 170 million investment in Ticketmaster for stock in Barry Diller's USA Networks, ultimately making better than twice his money on the deal, and in August it was revealed that Allen (who is worth $25 billion) sold $1.3 billion of his Microsoft stock.

EVERYONE'S SAYING: Former employees gripe privately that Allen is largely an absentee owner who nonetheless insists on micromanaging when he's in town. (He's often away at his homes in Beverly Hills, France, and Manhattan's Fifth Avenue, or on his 199-foot yacht.) He also came under attack in a Seattle paper, which discovered that in order to subsidize construction of Allen's new, 72,000-seat football stadium the state had resorted to selling scratch-offlottery cards for $2 apiece. The stadium was being financed by exploiting the ignorant poor! (What would you expect from a fellow who evicted a summer camp so he could turn its island into an estate?)

WOULD YOU BELIEVE: Every year, Allen throws an extravagant weekend-long party in a glamorous, far-flung locale. Last year's event took place at the Palazzo Pisani Moretta in Venice. This year the festivities were held in Alaska in late August. Friends received a massive, impressively detailed, leather-bound invitation which arrived in a box, and Allen chartered airplanes from Boeing to fly 400 or so friends from London, Seattle, New York, and Los Angeles. The two-and-a-halfday bacchanal (which took place, in part, on a rented cruise ship) is estimated to have cost $10 million.

THE YEAR AHEAD: -►

No. 31 John DOERR

PARTNER, KLEINER PERKINS CAUFIELD & BYERS

LAST YEAR'S RANKING: 24

DEALS AND DEEDS: As the technocracy's chief influence peddler, the famed investor seemed to spend much of his time whispering in the ear of A1 Gore; during the last year they've met so often that the joke in Cyberville is "Gore and Doerr in 2004!" (Never mind that Doerr is a registered Republican.) Doerr even kept a straight face when Gore proposed a 24-hour space-cam broadcasting Earth photos over the Internet. Despite such embarrassments, Doerr's highly publicized wonkfests finally began to pay off in actual policies. His pal Bill Clinton proclaimed that he wouldn't slap any new taxes on commerce conducted over the Internet, and California's outgoing governor, Pete Wilson, responded to Doerr's call for more charter schools. Likewise, Doerr tried to push through a $10 million bond in Woodside, California (the Beverly Hills of Silicon Valley), when he realized that his own kids, who go to the local public school, spent the day in old, leaky classrooms—with no Internet access!

EVERYONE'S SAYING: Insiders have noticed that the 47-year-old Doerr—known for launching star companies such as Amazon.com, Compaq, and Sun Microsystems—hasn't had any really big new hits lately in his day job as a venture capitalist. He relinquished the C.E.O. spot at TechNet, the PAC he founded. He often attends San Francisco high-society events despite being known for his disheveled hair, rumpled suits, and electronic gadgetry poking out of his pockets.

WOULD YOU BELIEVE: That Doerr is such a lousy driver that he has to be chauffeured— a situation which is considered gauche in laid-back Northern California. And friends laughed when the Doerrs' home was described in the press as a "row house." It's really a gated Pacific Heights mansion, and it's rumored that Doerr had the roof of a neighboring house lowered so he'd have a better view of the bay.

THE YEAR AHEAD: *

No. 32 Brian ROBERTS

PRESIDENT, COMCAST CORPORATION

LAST YEAR'S RANKING: 19

DEALS AND DEEDS: Roberts enjoyed the long, lingering aftereffects of Bill Gates's $ 1 billion investment in Comcast, which set off a tidal waVe of interest in cable companies: Paul Allen bought two, and AT&T announced a merger with the biggest one, TCI. Meanwhile, Comcast's stock price doubled, proving that, whatever else Bill Gates may be, he's a shrewd investor. Gates and Wall Street are betting that the cable guys will be the ones who bring us the high-speed, interactive multimedia networks we've been promised for years. For his part, Roberts took that cool billion from Gates and used it to upgrade his system so it can provide telephone service and high-speed Internet hookups, which represent at least intermediate steps toward true digital Nirvana.

EVERYONE'S SAYING: People used to whisper that he got to run Comcast only because his father owned the company. But the 39-yearold Roberts fils is the visionary who stuck with cable through its lean years and made Comcast the most technologically advanced of the cable players. Last October, 77-year-old Ralph Roberts gave his son control of the company's voting shares.

WOULD YOU BELIEVE: Comcast insiders say Roberts and Bill Gates were the mystery bidders against John Malone for the controlling block of TCI shares that came on the market last year. The word at Comcast is that the boss's intentions were honorable. When Gates approached Roberts to see if he'd join him in the last-minute bid, Roberts, sources say, felt he had to say yes. "Our view was if Microsoft was going to do it, it was better to have a cable company control TCI than Microsoft," says one Comcast insider. In the end, the MicrosoftComcast bid, submitted by Lazard Freres, came in too late to be considered.

THE YEAR AHEAD: *

No. 33 Michael DELL

CHAIRMAN AND C.E.O..

DELL COMPUTER CORPORATION

LAST YEAR'S RANKING: NONE