Sign In to Your Account

Subscribers have complete access to the archive.

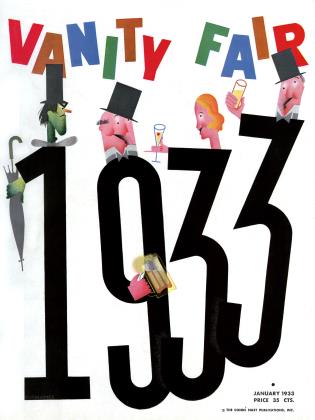

Sign In Not a Subscriber?Join NowTHE WORLD ECONOMIC CONFERENCE—1933

J. M. KEYNES

■ It will be a few months yet before the Conference proper meets; a few months more before it reports; probably a further passage of time before the report can lead to any action. The world, therefore, should not base hopes upon it for the spring or summer of 1933. Yet we need not greatly regret the procrastination. For in the first six months of 1933 the world will be wondering between two alternatives; and until the doubt is resolved, it would be vain to expect genuine decisions from an International Conference. The alternatives are these: Will it be apparent by the middle of 1933 that this slump is the same in kind as past slumps, though so violent in degree, and is gradually working itself off by the operation of natural forces and the economic system's own resiliency? Or shall we find ourselves, after a modest upward reaction and dubious hopes of recovery, plunged back again into the slough? So long as there is any prospect of our realising the first alternative—and its realisation is not impossible —we may be certain that an International Conference will confine itself to pious words. Only in the other event, with hopes dashed and the oppression of renewed and universal despair terrifying the delegates, will there be any chance of action commensurate with the problem. If, therefore, there is a risk that the second alternative will materialise— which is not so very improbable—I should wish the Conference to be still in session at the moment when the world realises that its hopes are not being fulfilled.

It is easy to predict the Agenda of the Conference. A number of resolutions will be passed declaring that many things ought to be changed, but without a serious intention of changing them. The Conference will agree in its collective capacity that tariffs and quotas have reached a pitch of absurdity and are a menace to international trade, but there will be no offers by individual countries to reduce them. Exchange restrictions will be denounced, but those countries where they exist will regret that they are in no position to abate them. It will be said that debts should be written down when they are beyond the capacity of the borrower, but no individual creditor will offer to write them down. The Conference will declare that there should be a general return to the Gold Standard as soon as possible, but those countries which have gained their liberty in this respect will not surrender it, except on conditions which they do not expect to see satisfied. The Conference may agree, even with French acquiescence, that prices should be raised. But will it offer any plan for raising them?

So long as the Conference deals with symptoms and not with causes, the shadow of futility will lie across its path. Its first task, therefore, should be to distinguish the one from the other. If we study the problem in that way, it is apparent that many of the evils with which the pious resolutions will deal, are symptoms. The latest extravagances of tariffs and quotas, exchange restrictions, the default of debts, the collapse of the Gold Standard, even the fall of prices itself, are mainly symptoms. No one has desired these things; none of them are the expression of deliberate policy; they have been forced upon us as the expression and the result of more fundamental forces. It is as though a Council of Doctors, summoned to cure colds in the head, were to pass resolutions that it is desirable to stop snuffing and that a man who coughs is a nuisance to his neighbours.

What, then, is the root of the matter upon which the Conference, if it were wise, would concentrate? It is not easily expressed in a few words; but I shall try to indicate its nature.

* The trouble began with something which is best described as "a state of financial tension". In the United States the causes of the tension were internal; elsewhere they were, in their origins, mainly international. These initiating causes are well known: on the one hand a frenzy of speculation in the United States, on the other hand a cessation of the international lending which had been offsetting the disequilibrium of the balances of payment between countries (which War Debts and Tariffs would have already produced otherwise). A state of financial tension means that individuals and communities suddenly find much increased difficulty in putting their hands on money to meet their obligations, with the result that they take various measures to reduce their purchasing. Others, not actually in difficulty, fear that the same thing may overtake them later, and from precaution reduce their purchasing also. The reduced demand, which is the same thing as reduced purchasing, causes prices to fall; the fall of prices diminishes profit; and the entrepreneurs of the world, whether they are in difficulties or not, have a diminished incentive to produce output or to make the purchases and create the incomes which would have accompanied it. Thus the declines in demand, in prices, in profits, in output and in incomes feed on themselves and one another.

When financial tension leads to a diminution in demand, the decline necessarily feeds on itself, because each step which an individual (or a community) takes to protect himself and to relieve his own tension merely has the effect of transferring the tension to his neighbour and of aggravating his neighbour's distress. The course of exchange, as we all know, moves round a closed circle. When we transmit the tension, which is beyond our own endurance, to our neighbour, it is only a question of a little time before, travelling round the circle, it reaches ourselves again.

Two spurious remedies are offered us. One is to endeavour to keep pace with the reduction in demand by an equal reduction in supply, i.e., by schemes of organized restriction. The other is to endeavour to keep pace with the fall in prices by an equal cut in wages. Each of these remedies may succour an individual producer if his neighbours refrain from it. But each of them destroys or diminishes someone's income (and therefore his purchasing power) so that, applied as all-round remedies, they aggravate the disease. I come to the fourth plan—the only safe exit which I can discern. It is on a theme capable of several variations, of which the essence is the same. The version which I shall outline is not my own, hut it is one which will. I hope, reach the ears of the Conference. It has already impressed favourably some good judges. Our plan must be spectacular, so as to change the grey complexion of men's minds. It must apply to all countries and to all simultaneously. Each at the same time must feel able to remove the barriers to trade and to purchase freely. If we all begin purchasing again, we shall all have the means to do so. The appropriate stimulus to the activity of trade will vary from nation to nation;—in some a relief from taxation, in some a programme of public works, in some an expansion of credit, in some a relaxation of exchange and import restrictions, in some a repayment of pressing debts, in some the mere removal of anxieties and fear, in some the mere stimulus to the lords of business to be courageous and active again. What is the charm to awaken the Sleeping Beauty, to scale the mountain of glass without slipping back? If every Treasury were to discover in its vaults a large cache of gold proportioned in size to the scale of its economic life, would not that work the charm? Why should not that cache he devised? We have long printed gold nationally. Why should we not print it internationally? No reason in the world, unless our hands are palsied and our wits dull.

There is one, and only one, genuine remedy: namely to increase demand—in other words, to increase expenditure. As the slump progresses, it becomes more difficult to do this. At first a relief in the financial tension would have been enough by itself. But when the decline of prices and profits has gone beyond a certain point, the incentive to produce, and not merely the financial ability, has disappeared. At this point, the State itself must, in my judgment, start the ball rolling by deliberately organising expenditure. But in any case the relief of the financial tension is the first condition for the success of any other measures. A few of the financially strong countries can help by their domestic financial policy. In recent months the United States has done much and Great Britain has done something along these lines. But a great part of the world is helpless until the tension is relieved for it internationally. It is for this reason that an international conference has a significant purpose. It is to this primary object that it should address itself.

The War Debts have played an important part in creating the tension. But they lie outside the scope of the Conference; and one can hope, moreover, that this problem is already in process of being solved. Their mitigation will offer an environment in which other measures, which would fail by insufficiency otherwise, may be worth while. I wish

all success to conversations for the abatement of tariffs and exchange restrictions. But we must remember that these things are measures of self-protection, of which individual countries cannot afford to deprive themselves unless some alternative protection is offered them at the same time.

® I come then to the core and kernel, which the Conference must reach if it is to find nourishment. Measures must be devised for the direct relief of financial tension between nations. Such measures will all fall, I think, into one of four groups of remedies. If anyone knows a fifth, let him declare it.

The first would provide for some consolidation of short-term debts which cannot be met and are now protected by standstills. 1 his is a very technical problem. The solution might be found in separating those debtors who could pay in terms of their national currencies from those who could not, and then providing for the appropriate Central Banks to take over the liability for the former whilst furnishing tlie Banks with the means to do so—which last requirement causes this group of remedy to be merged in the others.

1 he second would seek for some writing down of privately-owned international debts to correspond with the change in the value of money, so the debtor countries producing raw materials would not be required to devote twice as great a volume of exports to the service of their debts as at the time when they were incurred. This appeals to my feelings of justice, but my practical sense views it more doubtfully. If prices do not rise, the debts are certain to be brought down by their own weight;—it will not need an international conference. But if it is our firm purpose to raise prices, the remedy may become unnecessary. Moreover it is not prudent to shake the investor's confidence in bonds at a moment when we are anxious to revive his interest in them.

Ihe third invites the creditor countries of the world to dip their hands into their pockets yet again, to put up a guaranteed loan for the benefit of the others. I bis will be strongly pressed from several quarters. But 1 am sure that the British and American Treasuries will fiercely resist it. And they will be right on their resistance. This kind of philanthropy will never be large enough in scale; the division of the burden will never be rightly agreed, nor will the division of the proceeds. For several years we have been trying to buy ourselves out of the mess by such means, and our attempts are a proved failure.

* The plan would be as follows. An international body—the Bank of International Settlements or a new institution created for the purpose—would be instructed by the assembled nations to print gold certificates to the amount of (say) $5,000,000,000. The countries participating would undertake to pass legislation providing that these certificates should he accepted as the lawful equivalent of gold for all contractual and monetary purposes. They would also undertake to provide a lawful ratio of equivalence, though not necessarily an unchangeable one, between gold and their national moneys. The gold certificates would then be distributed to the participants in proportions determined by a formula, based on their economic weight in the world, subject to two conditions. The first would require the payment of a very small rate of interest to provide a guarantee fund against infringement of the second condition, ultimately returnable if not required for this purpose. The second would provide for the gradual withdrawal of this international fiduciary note issue in the event of an index number of the chief articles of international trade recovering to an agreed level. This plan should appeal to those who wish to see the world return as nearly as possible to the gold standard, and also to those who hope for the evolution of an international management of the standard of value. I see no disadvantages in it and no dangers. It requires nothing but that those in authority should wake up one morning a little more elastic than usual.

® I he delegates to the World Conference should assemble in sackcloth and ashes with humble and contrite hearts. It is, I suppose, well nigh the fiftieth of post-war Conferences. Fear and greed, duplicity and incompetence, but above all conventional thought and feeling, have brought their collective performance far below the level of the participants regarded as human individuals. But here is a last opportunity. Finis coronal opus.

View Full Issue

View Full Issue

Subscribers have complete access to the archive.

Sign In Not a Subscriber?Join Now