Sign In to Your Account

Subscribers have complete access to the archive.

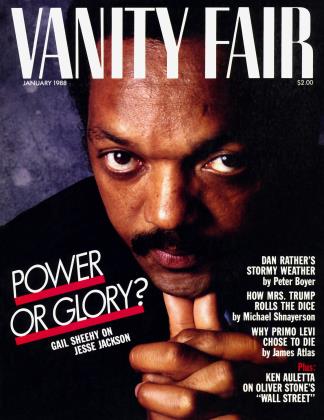

Sign In Not a Subscriber?Join NowSTONE'S BROKERS

Wall Street, Oliver Stone's dead-on movie about the market, does for brokers what Bleak House did for lawyers

BY KEN AULETTA

Movies

On the day I saw Oliver Stone's new movie, Wall Street, the stock market plunged 508 points—the largest one-day fall ever— and panic replaced euphoria on the real Wall Street. It had been a euphoria fueled largely by greed, which is Stone's subject. Himself the son of a successful broker, Stone seems to believe that the Wall Street barrel is rotting.

The movie tells the tale of Bud Fox (Charlie Sheen), son of a blue-collar grunt. Fox spends his days as a broker hunched over a Quotron machine, guessing and throwing out stocks as if they were baseball cards, soliciting customers by phone, daydreaming of "bagging an elephant"—a wealthy customer who will open the door to Pleasure Island. Unless you believe that most people who work on Wall Street knowingly commit felonies (I don't), Bud Fox is not your typical broker or banker. He becomes a thief. But in so many other ways—his fevered ambition, the way he pirouettes precariously along the fault line separating right from wrong, his hunger to get an edge, do the deal, make a score, win a short-term victory—Fox is an emblem for the casino-like culture that has dominated the Street and, in some ways, America itself.

Bud Fox is looking for shortcuts. The "elephant" he sets out to bag is Gordon Gekko (Michael Douglas), an Ivan Boesky-type character who turns out to have an affinity for Fox. He, too, is from a blue-collar family. He, too, like other celebrated predators of the moment—T. Boone Pickens, Carl Icahn, Saul Steinberg, Asher Edelman—sees himself as an outsider, a buccaneer engaged in a kind of war against the blue bloods and bureaucrats who they claim rule investment banking and corporate America and have allowed corporations to grow fat and uncompetitive.

In the private realm, Gekko's walls glitter with art; he joins prestigious cultural boards, raises funds for the right charities, dines in the right restaurants, is celebrated in gossip columns, and cuts a dashing figure with his slicked-back wavy hair, manicured fingernails, and Savile Row suits. In his business life, Gekko is an impatient killer who paces behind his desk like a caged animal. This is the sort of man who, no doubt, instructs his children to be patient and share their toys, while instructing business colleagues to live for the moment, to maximize short-term-shareholder values, to gouge out an opponent's eyes if necessary.

Fox starts trading for Gekko, using inside information. "You do good and you get perks," Gekko tells him, "lots and lots of perks"—the kinds of perks that lure roughly one-third of our business-school graduates into investment banking. Acquisitions—from the red Ferrari to the Fifth Avenue co-op to the palace in the Hamptons—become obsessions, another way of keeping score. And so Fox trades his brown suits for navy blues, dons red suspenders, buys a $950,000 apartment on the East Side stocked with every imaginable appliance, and acquires a beautiful interior decorator (Daryl Hannah).

Fox is a so-called yuppie, but he has not somehow infected his company with an alien morality, which was the line of defense peddled by many elders on Wall Street soon after the insider-trading scandal exploded. Blame it on the yuppies, they said. Assume for the sake of argument that "yuppies" are generally callow, young Clyde Griffiths burning with unregulated ambition. They still don't rule Wall Street. Corporate America is stratified, with lines of authority and chains of command. The value system comes from the top down, not the bottom up. Bud Fox is responsible for his actions, but so is the senior executive who doesn't care how Fox makes sales—as long as he makes them.

What Fox hears from his boss and Gekko is the language of war, talk of "pre-emptive strikes" and "Pacman defenses." Mergers-and-acquisitions specialists go off to battle and return home as rich and celebrated gladiators. The fullpage GTE Spacenet ads proclaim: "Business Is War." The course Asher B. Edelman teaches at the Columbia School of Business, the one in which he offered a $100,000 bounty to any student who unearthed a company he could swallow, is titled: Corporate Raiding—The Art of War. The analogy is an excuse, as well as a description. Cutthroat behavior is expected on the corporate battlefield.

Sleazy operators like Gekko require information, so Fox starts to put together an insider ring, along the lines of that of Dennis Levine. He persuades a lawyer friend to feed him information on pending deals. "Oh relax, Roger. Everybody's doing it," he says. Like Boesky's accomplice, Boyd Jefferies, he whispers code words into the phone, and a network of arbitrageurs put companies in play. Like Martin Siegel, he tells fellow brokers of "sure things." No supervisor asks— as they didn't with Levine or Siegel— where the information came from. This all goes under the excuse of seeking an "edge," as Wall Street calls it. Bud Fox becomes a golden boy at his firm—until the Stock Exchange and the S.E.C. nab him, as in real life they nabbed Boesky, Levine, Jefferies, Siegel, and more than fifty others in the past two years. And like most of the real-life thieves, Bud Fox makes his deal with prosecutors.

Stone's gloomy picture of life on the Street belies his own mixed feelings about that world. "I'm ambivalent about capitalism," he says. "Marxism may work on paper, but it doesn't work in practice. My father used to say people need incentives, and I believe fundamentally in that fact." But he was pleased when Barry Diller, chairman of the board of Fox, the studio that produced Wall Street, came out of an early screening and pronounced: "I've never seen a movie or read a book that made me so disgusted by the excesses of capitalism." Critics less close to the film than Diller may insist that it is too rough on its subject, but not by my lights. One need not reside on the political left to make a case against many Wall Street practices. An Edmund Burke conservative can make a case that the market is dominated by promiscuous liberals who live for the moment and lack memory, who have no deep loyalties to clients and don't worry about long-term shareholders. The stock market is volatile not just because of trade and budget deficits— which have coexisted quite nicely for five years with the most rampant bull market in history—but because brokers focus less on the "fundamentals" of companies than on fluctuating prices. When the stock slips, computers are programmed to sell. The recent cutbacks at Salomon Brothers and other Wall Street banking houses reflect an industry that has become bloated, taken on too much overhead, too much debt. Investment bankers became part of an industry that did not observe limits. They thought they could have it all.

Indeed, a Burkean conservative—or anyone with common sense—could make the same observation about Washington. It is perhaps no accident that the riotous greed that has gripped Wall Street and the record-shattering bull market that ran as long as a hit play coincided with the advent of the Reagan administration. For this is an administration with an abhorrence of government. It fervently believes, against all evidence, in the

rationality of a free market. Therefore, anything goes. If the market supports takeovers, and allows foreign ownership of critical industries, and encourages conglomeration— great. (Of course, the Democrats blame the Republicans for the deficit, yet want to spend more.) The reality gap in Washington is a canyon as deep as the budget and trade deficits.

Most people on Wall Street aren't felons. Nor does Stone's movie suggest they are. There are heroes on the screen—the Hal Holbrook broker who won't play the game; Bud Fox's father, who works with his hands and defends his union and employer; Larry Wildman, the former takeover player who has become an investor interested in saving airlineand steel-company jobs as well as in turning a profit. But the heroes are rare. Conformists to the ganglike peer culture are the norm. And unlike Martin Siegel, who stuffed his briefcase full of Ivan Boesky's cash, those who cut comers or seek an edge often do so with a clear conscience. After a while, the line between right and wrong becomes blurred. Speaking of Bud Fox, Stone says, "The character slips into it. You don't do it one day. You do it in small steps."

One can't walk out of Oliver Stone's movie without the sense of having watched a morality tale. There are moments of preachiness—near the end of the movie when Bud Fox leans over his East Side balcony and portentously contemplates who he is, for instance. And though Michael Douglas and most of the other actors are convincing, I was never persuaded that the shallow Bud Fox could be so quickly transformed into a cunning comer-cutter. Charlie Sheen is too one-dimensional for that. His baby face is simply too innocent, too reliant on one expression, for him to get by as a con man. But there has never been a more authentic movie about frenzied Wall Street. Brokers and bankers will walk out of theaters boasting about how Stone made their business come alive. I came out thinking that at a moment in our culture when Harvard and other business schools are vexed about whether ethics can be taught, Stone has cut through the whole silly debate. Of course ethics can be taught: in schools, in personaltraining programs, in movies.

When I spent a lot of time on Wall Street a few years ago, I often asked bankers, "What wouldn't you do? What deal would you turn down?" What surprised me was that most of the people I posed the question to seemed never to have thought of limits before. They were so successful, so busy, so amply rewarded with their $1 million or $4 million bonuses, that they didn't take time to think about dos and don'ts.

"I'm ambivalent about capitalism," Stone says. "My father used to say people need incentives, and I believe fundamentally in that"

This promiscuity helped place us in the middle of what seems to be a market earthquake. Reality has intruded. It is not "morning" in America, as Ronald Reagan's ads proclaimed, but the day after. America has a hangover. And the market collapse is a symptom of an even deeper malady, a greed so unbridled that it became pathological. Sadly, Oliver Stone's searing Wall Street turns out to be a documentary. □

View Full Issue

View Full Issue

Subscribers have complete access to the archive.

Sign In Not a Subscriber?Join Now