Sign In to Your Account

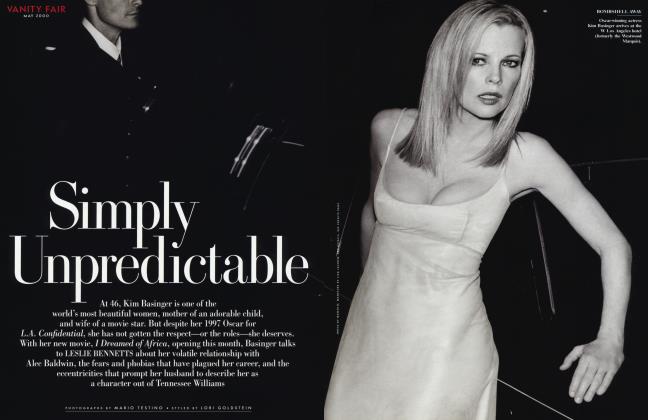

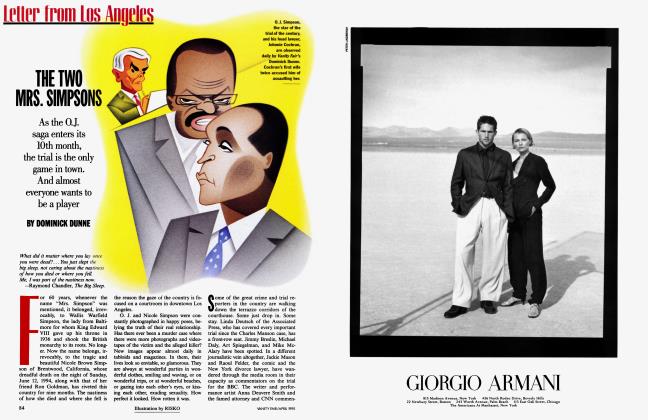

Subscribers have complete access to the archive.

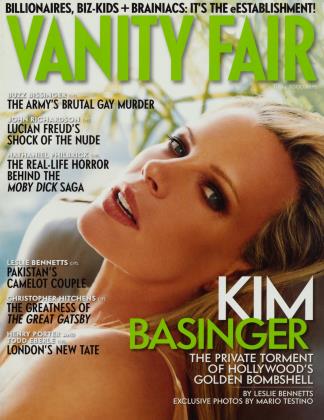

Sign In Not a Subscriber?Join NowTHE eSTABLISHMENT 50

THE KINGS AND QUEENS OF eCOMMERCE, eMEDIA, eENTERTAINMENT, eEVERYTHING

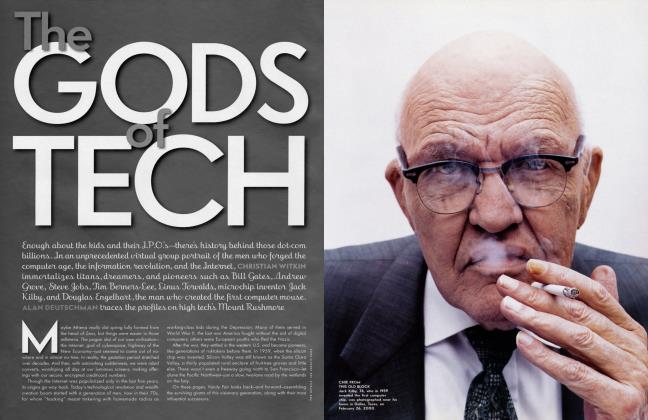

ALAN DEUTSCHMAN

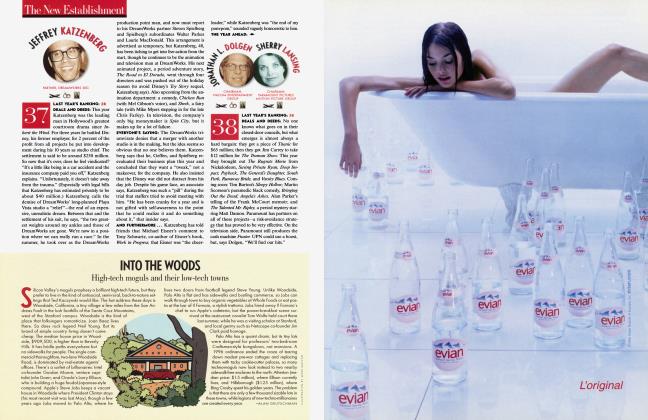

SIX YEARS AG Vanity Fair introduced its readers to the New Establishment: the 50 leaders of the convergence of information, technology, and entertainment. Since then the Web has emerged as the most astonishingly lucrative and dynamic part of this global trend. The Internet's top players constitute a new new establishment—we've named it ''the eEstablishment" and picked out 50 charter members for you to meet.

These are the people spearheading the longest economic expansion in American history, the greatest rush of wealth creation since the Gilded Age of the robber barons at the turn of the last century. It all began when Netscape, which made software for surfing the Web, had its boffo initial public offering in August 1995 and the stock exploded 108 percent in its first day. Since then more than 300 Internet companies have gone public. Their combined market value is about a trillion dollars, or one-ninth the size of the U.S. gross domestic product. The scale of the Internet craze is staggering: today, 56 million of America's 100 million households have computers, and 41 million are on-line, where we spend 615 million hours a week of our personal time, according to the Odyssey research firm.

Silicon Valley's insiders are betting that the boom is just beginning. Last year the elite cadre of professional venture capitalists invested $25 billion in Internet start-ups. That figure alone is awesome, but it doesn't include all the individual investors who bet on new companies— whether they were cashed-out moguls with a spare $100 million to play around with (and there are a lot of those) or twentysomethings with only a wallet full , of credit cards (such as Jason Olim, who made his fortune with CDNow, which sells CDs on the Web).

"Making it" in Silicon Valley used to mean piling up $10 million. Now $100 million is the goal for new entrepreneurs, who write business plans that look ahead only 12 months, by which time their companies presumably will have been bought for mind-boggling sums by Microsoft or AOL and the founders can retire to a sunny beach. No wonder, then, that so many corporate titans are forgoing the status and security of their Old Establishment sinecures for the chance to run risky new ventures (such as George Shaheen, who quit as C.E.O. of giant Andersen Consulting and went to Webvan, a grocery-delivery service). Students are dropping out of Harvard Business School, joining start-ups, and making piles of money before their classmates finish their M.B.A.'s. In San Francisco, at the Bay Area Video Coalition, a nonprofit organization that teaches Web-site design and production to welfare recipients and displaced workers, graduates of the four-month program are making as much as $50,000 a year.

Is it all just a speculative bubble that's ready to burst? At times it may seem like little more than a mania, and many of today's stars are apt to burn out quickly. But there's a solid underpinning to the boom: the fact that technology is rapidly getting radically better and opening new possibilities. Today your P.C. probably has 28 million transistors, which is a rough measure of its power. By 2010, thanks to steady advances in miniaturization, a typical P.C. may have one billion transistors, making it some 35 times more capable. These new chips, coupled with the fast Internet connections coming from the phone and cable companies, will make possible all kinds of unexpected new things. Intel's scientists envision wall-size interactive video displays that you can talk to.

It's hard to predict exactly who will win and lose in the ongoing rush, but here are 50 players who are worth watching. In selecting them, we considered several factors: We looked at Media Metrix, a sort of Nielsen rating for Web sites. We took note of I.P.O.'s that had amassed great paper wealth for companies and individuals. Then we considered intangibles such as staying power, influence, strategic importance, and the buzzy x factor. Only those associated with U.S.-based companies were eligible. We chose to exclude the New Establishment players, who can count themselves as ex officio mandarins of this younger club. (We'll revisit them in October.) Instead, we assembled the field marshals who are leading these Internet invasions.

Meet the eEstablishment ...

EDITOR'S NOTE: Below are members of the New Establishment who are honorary members of the eEstablishment 50. which introduces a new group of players who haven't appeared before in our annual surveys of leaders of the Information Age.

Bill Gates, chairman and chief software architect. Microsoft Corporation; Steve Ballmer. C.E.O.. Microsoft: Gerald Levin, chairman and C.E.O.. Time Warner Inc.; Steve Case, chairman and C.E.O.. AOL; Ted Turner, vice-chairman. Time Warner Inc.; Barry Oilier, chairman and C.E.O., USA Networks. Inc.; Michael Eisner, chairman and C.E.O., the Walt Disney Company; Louis Gerslncr, chairman and C.E.O., IBM Corporation; Andrew Grove, chairman, Intel Corporation; Craig Barrett. C.E.O.. Intel; Jeff Bezos, chairman and C.E.O., Amazon.com; Bob Wright, president and C.E.O.. NBC; Jerry Yang, chief Yahoo; David Filo, chief Yahoo; Tim Koogle. C.E.O., Yahoo; Paul Allen, chairman. Vulcan Northwest Inc.: John Doerr. partner, Kleiner Perkins Caulicld & Byers; Lawrence Ellison, chairman and C.E.O.. Oracle Corporation: Margaret Whitman. C.E.O., eBay Inc.; Scott McNealy, chairman and C.E.O., Sun Microsystems. Inc

PAM ALEXANDER

PRESIDENT AND C.E.O., ALEXANDER OGILVY 1987 AS ALEXANDER COMMUNICATIONS; ACQUIRED BY OGILVY IN 1998

How she made it: No one is better at talking up the influential insiders than Alexander. Her public-relations firm is like the techie F.B.I.: it keeps detailed dossiers on the mind-sets and habits of 25,000 journalists, stock analysts, and other opinion leaders. Its minions E-mail instant updates to the database about what's said at 4,000 conferences and events a year (whether onstage or behind the scenes). Alexander herself travels constantly and knows everyone. Her eEstablishment clients have included Jim Clark (Healtheon/WebMD, myCFO), Bill Gross (Idealab), Joseph Nacchio (Qwest), and Toby Lenk (eToys), and she's counseled Rupert Murdoch and venture capitalist John Doerr. She works with start-ups from their earliest stages.

RICHARD BELLUZZO

AGE: FOUNDED I.P.O.: 3/86 GROUP VICE PRESIDENT, MICROSOFT $520.5 BILLION*

How he mode it Belluzzo is Microsoft's Internet chief, responsible for a network of Web sites that attract more than 40 million visitors a month, placing it third behind AOL and Yahoo. Among its top Web properties: Expedia, which sells plane tickets, and CarPoint, for buying new and used cars. Belluzzo, who went to a local college in San Francisco, shot through the ranks at Hewlett-Packard (he was called "Rocket Rick") and was a likely candidate for C.E.O. there before he jumped ship.

*THREE TIMES GREARER THAN G.M., FORD, AND DAIMLERCHRYSLER COMBINED

SCOTT BLUM

FOUNDER, BUY.COM AGE: FOUNDED I.P.O.: S2 BILLION PERSONAL STAKE IN COMPANY: $978 MIWON

How he made it: Blum, an adolescent swimming champ, was kicked out of high school for driving the principal's golf cart into a pool. At 19 he parked cars at the Ritz-Carlton in Laguna Niguel, eyeing the beach houses nearby. He launched Buy.com, which sold stuff—computers, books, videos, games—at cost or below. The idea was that it would make money from ads, but so far the only profits have come from selling its stock. Now Blum owns a stunning beach house—right next to the Ritz.

ERIC BREWWE

CO-FOUNDER AND CHIEF SCIENTIST, INKTOMI AGE: FOUNDED: 1996 I.P.O.: 6/98 $18.8 BILLION* PERSONAL STAKE IN COMPANY: $1.3 BILLION

How he made it: Inktomi means clever spider in a Native American language. This spider has a huge web: it can search for every instance of a given word on more than 110 million Web pages. Its technology is used by Yahoo, AOL, Excite@Home, and NBC's Snap. It sprang out of a research project Brewer designed as an assistant professor of computer science at U.C. Berkeley. Inktomi is now housed in luxury Silicon Valley offices, but its early employees had to step over homeless people to get in the door of the cramped original offices.

•FOUR TIMES GREATER THAN BEAR STEARNS.

CANDICE CARPENTER

CO-CHAIRPERSON OF THE MARKET PERSONAL STAKE BOARD AND C.E.O., IVILLAGE AGE: FOUNDED: P.O.: VALUE: $690.4 MILLION IN COMPANY: $20 MILLION

How she made it: Charismatic and athletic (she's a rock climber), Carpenter spent eight years as an Outward Bound instructor before getting a Harvard M.B.A. and morphing into a Time Warner executive. Barry Diller tapped her to run Q2, the upscale channel of QVC, and became an important mentor. With backing from AOL and venture capitalists at Kleiner Perkins, she built iVillage into one of the biggest Web sites for women, though now she faces tough new competition from Oxygen, Geraldine Laybourne's upstart network for women.

•GREATER THAN PLAYBOY ENTERPRISES.

MARKET VALU reflects the closing market price as of March 9, 2000, unless otherwise indicated.

PERSONAL STAKE IN C0MPAN reflects the value, as of March 9, 2000, of actual shares plus paper profits in unexercised stock options; information available for top five executive officers of public companies as indicated in S.E.C. filings.

DAN CASE

CHAIRMAN AND C.E.O., 1968 AS HAMBRECHT & QUIST; ACQUIRED IN PERSONAL STAKE CHASE H&Q AGE: FOUNDED: 1999 BY CHASE MANHATTAN FOR SI.35 BILLION IN COMPANY: Sill MILLION*

How he mat The older brother (by 13 months) of AOL's Steve Case is a power in his own right. Dan was a Rhodes scholar and, at age 33, the C.E.O. of Hambrecht & Quist, the San Francisco investment bank that handled the I.P.O.'s of Apple and Genentech. Since then Dan's firm has co-managed the stock offerings of Internet stars like Netscape and Amazon, making him a financier for the new era.

•BASED ON THE FINAL STOCK PRICE OF HAMBRECHT & QUIST ON DECEMBER 10. 1999

JOHN CHAMBERS

PRESIDENT AND C.E.O., MARKET PERSONAL STAKE CISCO SYSTEMS FOUNDED: IPO.: VALUE: $476.6 BILLION* IN COMPANY: $1.6 BILLION

How he made it: Cisco, the biggest maker of the hidden hardware that powers the Internet, has become one of the most valuable companies in the world. Chambers, a former IBM salesman with a southern accent, has become a sort of global ambassador for the digital revolution: in the past year he met with more than 30 heads of state, including Britain's Tony Blair and China's Jiang Zemin. Not bad for a dyslexic kid from West Virginia who struggled to learn to read.

•ALMOST THREE TIMES GREATER THAN AT&T.

JIM CLARK

CO-FOUNDER AND DIRECTOR, HEALTHEON/WEBMD

FOUNDER AND CHAIRMAN, MYCFO

Ho~ he rnadc it An unstoppable "serial entrepreneur," Clark scored big hits with Silicon Graphics and Netscape. Then the ornery Texas native became obsessed with building computer-controlled sailboats like his 155-foot Hyperion. In his spare time he's trying to revolutionize health care by getting medical information into on-line databases with his current flagship, Healtheon/WebMD. Clark, whose net worth is estimated to be near $2 billion, was once an associate professor at Stanford and recently donated $150 million to the school.

•FIVE TIMES GREATER THAN OXFORD HEALTH PLANS.

CHARLES CONN

C.E.O., TICKETMASTER ONILINE-CITYSEARCH

How made it Hollywood mogul Barry Diller's Ticketmaster is the dominant player in ticket sales. By merging with CitySearch and buying Sidewalk.com from Microsoft, he has put together the most popular on-line guide to what's happening in major cities. Diller's point man on the Web is Conn, a Rhodes scholar and Harvard M.B.A., who lived in Japan before co-founding CitySearch in 1995.

CHRISTOS COTSAKOS

CHAIRMAN AND C.EO., MARKET PERSONAL STAKE E-TRADE GROUP AGE: FOUNDED: 1992USB8/96 VALUE: $7.4 BILLION* IN COMPANY: $137 MILLION

The son of Greek immigrants, Cotsakos received a Purple Heart and Bronze Star in Vietnam, where he led infantrymen during the Tet Offensive. Back home he was a FedEx executive and president of ACNielsen before risking his career on starting E-Trade. When the on-line stock-trading site launched in 1996, he took out big ads which read: "Your broker is now obsolete." He beat giant Charles Schwab to the Web—and later undercut its on-line commissions.

•GREATER THAN PAINEWEBBER GROUP.

JOY COYEY

VICE PRESIDENT, AMAZON.COM AGE: FOUNDED: P.O.: MARKET $23.5 BILLION* VALUE:

As Amazon's chief financial officer, Covey was credited with selling Wall Street on its controversial plan of amassing huge losses while it races to build a huge business. Her personal life has been turbocharged, too: she finished college by 19, then got a Harvard law degree and M.B.A. She is now worth an estimated $200 million. Covey and her guests rode snowmobiles to her outdoor wedding. Once, before a big meeting, she left her dress shoes on a plane—and bought a pair from a woman waiting at Baggage Claim.

•EIGHTEEN TIMES GREATER THAN BARNES * NOBLE

MARK CUBAN

DIGITAL YAHOO, YAHOO AGE: FOUNDED: P.O.: 7/98 AS BROADCAST.COM; ACQUIRED PERSONAL STAKE BY YAHOO FOR S5.7 BILLION IN 1999 IN COMPANY:

Cuban is a sports fan who wanted to listen to broadcasts of basketball games that wereji't carried on his local TV and radio stations. He co-founded Broadcast.com, a Web site that picks up the play-by-plays of more than 450 college and pro teams from all over. He also attracted 1.5 million viewers to his landmark 1999 Webcast of a Victoria's Secret fashion show. Yahoo bought the company for nearly $6 billion in stock in 1999, making Cuban (who now owns the Dallas Mavericks) a bachelor billionaire.

•BASED ON THE CLOSING STOCK PRICE OF BROADCAST.COM ON ITS FINAL DAY OF TRADING, JULY 20, 1999.

JEFFREY DACHIS AND 2CRAIG KANARICK

'CO-FOUNDER, PRESIDENT, AND C.E.O., RAZORFISH

AGE:

2CO-FOUNDER AND CHIEF SCIENTIST, RAZORFISH

AGE:

FOUNDED:

FOUNDED:

1995 iTCOU 4/99

1995 U£fl4/99

MARKET

VALUE:

MARKET

VALUE:

S3.3 BILLION*

$3.3 BILLION*

PERSONAL STAKE IN COMPANY:

$176 MILLION

PERSONAL STAKE IN COMPANY:

$176 MILLION

How they made it Among the handful of leading agencies that design Web sites and create marketing campaigns aimed at the cyber generation, Razorfish's "Silicon Alley" presence has given it especially strong buzz. Marquee clients include Ralph Lauren, Time Warner, CBS, NBC, and AOL. Co-founders Dachis and Kanarick are the only avant-gardists of the early (circa 1995) Manhattan cyber-arts scene who made it really big in the Web boom.

•TWO TIMES GREATER THAN SOTHEBY'S.

PRESIDENT AND C.E.O., LYCOS

AGE:

FOUNDED:

1995 ITTiM 4/96

MARKET

VALUE:

$8.2 BILLION*

PERSONAL STAKE IN COMPANY:

$155.9 MILLION

BOB DAVIS

How he made it Davis was a star salesman at G.E. and Wang, a practical joker who cleaned out colleagues' desks while they were absent and moved around their cars. Investor David Wetherell recruited him to run Lycos, now the most trafficked Web network after those of AOL, Yahoo, and Microsoft. But later Wetherell, who controlled almost 20 percent of Lycos's stock, blocked Davis's plan to merge with Barry Diller's USA Networks. Despite the failed merger, Lycos and USA maintain a close working relationship.

•GREATER THAN NIKE.

JUDY ESTRIN

CHIEF TECHNOLOGY OFFICER, CISCO SYSTEMS

AGE:

FOUNDED:

1984 vng 2/90

MARKET

VALUE:

$476.6 BILLION

How she made it Estrin was raised in the tech world: her parents, both professors, helped build the first computer in the Middle East. One of her father's U.C.L.A. students, Vint Cerf, became the father of the Internet—and Estrin's teacher at Stanford. Estrin co-founded three successful start-ups. Now she's the C.T.O. of Cisco, perhaps the most important maker of the Internet's hardware, and sits on the boards of Disney, FedEx, and Sun Microsystems.

ROB GLASER

CHAIRMAN AND C.E.O., REALNETWORKS

AGE:

FOUNDED:

1994 mm 11/97

VALUE:

$12 BILLION*

PERSONAL STAKE IN COMPANY:

$2.2 BILLION

How he made it Glaser spent a decade at Microsoft, where he was one of the most precocious stars before he burned out at 31. He reemerged as one of Gates's most irascible rivals, coming to dominate the market for software that plays audio and video clips from the Web. In 1998 he made headlines for testifying against Microsoft during the company's anti-trust hearings in Washington.

_ *TWO TIMES GREATER THAN HERSHEY FOODS.

BILL GROSS

C.E.O., IDEALAB

AGE:

FOUNDED:

MARKET

VALUE:

PRIVATELY HELD

How he made it Gross, a Caltech genius type, worked closely with Steven Spielberg to create children's educational software at Knowledge Adventure, which Gross sold for $100 million in 1996. Since then he's been manically generating good ideas for new companies: his Idealab in Pasadena, California (estimated to be worth as much as $10 billion), has launched 30 Internet start-ups so far. Gross sits on the boards of 20. Big hits include eToys and GoTo.com, which went public, and CitySearch, which he sold to Barry Diller.

GARRETT GRUENER AND 2ROBERT WRUBEL

CO-FOUNDER, ASK JEEVES

'PRESIDENT AND C.E.O., ASK JEEVES

AGE:

AGE:

FOUNDED:

FOUNDED:

1996 IT70H 7/99

MARKET

VALUE:

MARKET

VALUE:

S2.4 BILLION

S2.4 BILLION

PERSONAL STAKE IN COMPANY:

PERSONAL STAKE IN COMPANY:

S245 MILLION

$105 MILLION

How they made it Web surfers can ask questions in plain English to the virtual Jeeves, who comes up with suggestions about Web sites that may have the answers. The tips are sometimes comically off the mark, but the idea has been appealing enough to attract millions of users. The company recently reached an agreement with the P. G. Wodehouse estate over its use of the famous character.

ELLEN HANCOCK

PRESIDENT AND C.E.O., MARKET PERSONAL STAKE EXODUS COMMUNICATIONS FOUNDED: P.O.: VALUE: $27 BILLION* IN COMPANY: $2.5 BILLION

Hancock, a 29-year IBM veteran, was fired—twice—by imperious bosses: first by Lou Gerstner when he remade Big Blue, then by Steve Jobs when he took over Apple. Gray-haired and unemployed at 54, she found an outplacement counselor to help her write a resume. She landed at Exodus, which runs the back-office computer centers that power Web sites like Yahoo and eBay, and became a multibillionaire, richer than Gerstner and Jobs together.

•GREATER THAN SEAGRAM.

RUSSELL HOROWITZ

CHAIRMAN AND C.E.O., G02NET AGE: FOUNDED: 1996 |Ha4/97 MARKET $2.6 BILLION PERSONAL STAKE $296 MILLION VALUE: IN COMPANY:

How he mo As Horowitz bought up Web sites in fields like investing, shopping, auctions, and game playing, Go2Net became one of the Internet's top 20 networks. Last year he sold 30 percent of the company to Paul Allen for $426 million and became a key player in Allen's digital empire. Now he's gearing up to provide interactive content to Allen's millions of cable-TV subscribers.

TOM JERMOLUK AND 2GEORGE BELL

CHAIRMAN, EXCITE@HOME AGE: FOUNDED: 1995 ITTia 7/97* MARKET $11.2 BILLION PERSONAL STAKE $188 MILLION VALUE: IN COMPANY:

PRESIDENT AND C.E.O., EXCITE@HOME AGE: FOUNDED: 1995 ITToi 4/96* MARKET $11.2 BILLION PERSONAL STAKE $30 MILLION" VALUE: IN COMPANY:

How they made h Bell was the head of Excite, a Yahoo-like Web "portal," and Jermoluk ran @Home, which provides high-speed Internet access to 1.1 million subscribers over cable-TV lines. The two merged last year in a $6.7 billion deal, but the combined company still looks like an undersized also-ran compared with huge rivals like AOL, Microsoft, and Yahoo. AT&T controls more than 50 percent of the shareholder votes and has been rumored to be interested in selling.

DATE OF @HOME'S I.P.O.

DATE OF EXCITE'S I.P.O.

VALUE OF OPTION HOLDINGS IS BASED ON HOLDINGS ON DECEMBER 31, 1997. VALUE OF BENEFICIAL HOLDINGS IS BASED ON HOLDINGS ON DECEMBER 31, 1998.

STEVE JURVETSON

MANAGING DIRECTOR, AGE: El FOUNDED: DRAPER FISHER JURVETSON 1985 PRIVATELY HELD

How he made it The son of Estonian immigrants, Jurvetson saved money by racing through Stanford in two and a half years—and still graduated first in his class. He went on to design chips for Hewlett-Packard, write software in nine computer languages, work for Steve Jobs, and become the youngest partner at one of the hottest venture-capital firms, which backed hits like Hotmail (a free E-mail service) and GoTo.com (a Web directory). He's already a legend in Silicon Valley: supersmart and technically savvy like John Doerr of Kleiner Perkins, but enviably young, outgoing, mediagenic, and handsome (he recently posed for a GQ photo spread).

SCOTT KURNIT

CHAIRMAN AND C.E.O., ABOUT.COM AGE: FOUNDED: 1996 lUTB 3/99 MARKET SI.6 BILLION PERSONAL STAKE $140 MILLION VALUE: IN COMPANY:

How he made it Kumit used to run marketing for the Prodigy on-line service, which lost its lead to AOL and was forgotten by history. But he's bounced back with About.com, which has experts on more than 700 subjects who can guide you through the Web to find what you want to know. Kumit has a long history with experimental media: he used to run pay-per-view for Viacom. And when he was growing up on Long Island, his father cut a hole in the wall so they could watch TV from the patio.

GERALDINE LAYBOURNE

CHAIRMAN AND C.E.O., OXYGEN MEDIA AGE: FOUNDED: MARKET PRIVATELY HELD VALUE:

How she made it A former schoolteacher, Layboume became a legend during the 16 years she spent building Nickolodeon, the children's TV channel, into an $8 billion powerhouse; she then worked briefly at Disney. Literally in a dream she conceived of Oxygen, which combines women's Web sites with a cable network. She has killer backers (Disney, AOL, Paul Allen) and fabulous partners (Oprah Winfrey, sitcom creator Marcy Carsey). But so far Oxygen's channel isn't carried in New York or L.A.

EDWARD "TOBY" LENK

PRESIDENT AND C.E.O., ETOYS FOUNDED: 1997 ITEM 5/99 MARKET $1.7 BILLION PERSONAL STAKE $142 MILLION VALUE: IN COMPANY:

How he made it Lenk, a Harvard M.B.A., did a stint as a Washington policy wonk before landing as the head of strategic planning for Disney's theme parks. But spending eight or nine years building a new park was too languid for Lenk. In 1996 he jumped to this startup, which hawks kids' books, videos, and software as well as toys. Now it's worth more than all of Toys "R" Us.

MICHAEL LYNTON

PRESIDENT, 1985 nig 3/92 MARKET INTERNATIONAL DIVISION, AOL AGE: FOUNDED: VALUE: $141.5 BILLION*

How he made it Lynton keeps leaping from one medium to another and quickly making his mark. At 33 he ran Disney's Hollywood Pictures, presiding over hits such as Crimson Tide. At 36 he became the head of book giant Penguin, and within four months he made it even bigger by buying Putnam Berkley, which publishes Tom Clancy and Patricia Cornwell. Now he's AOL's point man for its big international push, the key to sustaining its incredible growth.

_ •GREATER THAN DISNEY AND NEWS CORP. COMBINED.

MARY MEEKER

MANAGING DIRECTOR, 1935 mjM 3/86 MARKET MORGAN STANLEY DEAN WITTER AGE: FOUNDED: VALUE: $95 BILLION

How she made it Institutional Investor has ranked Meeker the No. 1 analyst of Internet and new-media stocks for the past four years. Barron's called her "The Queen of the Net." She built her reputation by alerting investors to stocks such as AOL when it was trading at $2 a share in 1993. Now she and rival Henry Blodget of Merrill Lynch are what traders call "the axes" on Web stocks, the analysts whose words can move markets. Her pay is reportedly $ 15 million a year, which is very high for a stock analyst but pales in comparison to the paper wealth of the Web moguls she helped to create.

HALSEY MINOR

CHAIRMAN, CNET FOUNDED: 1992 lUni 7/96 MARKET S5.I BILLION* PERSONAL STAKE $729.6 MILLION VALUE: IN COMPANY:

He's a preppy southerner who worked as an investment banker on Wall Street before hitting on the idea for a TV show and Web site about computers. Paul Allen was a key backer, and Kleiner Perkins's John Doerr a close friend. In hipper-thanthou San Francisco he stands out as a golf-playing, khaki-clad young fogy who holds dinners in the wine cellars of formal restaurants such as Masa's.

♦GREATER THAN WHIRLPOOL.

MICHAEL MORITZ

PARTNER, SEQUOIA CAPITAL PRIVATELY HELD

Moritz got to know the moguls of Silicon Valley in the early 1980s, when he was Time's San Francisco correspondent, and he decided that he was as smart as they were. He went native by joining Sequoia, one of the most prestigious venture-capital firms, which had helped finance Apple and Cisco. He made his own mark by discovering a couple of Stanford students who called their company Yahoo. His $ 1 million investment is now worth several billion.

JOSEPH NACCHIO

CHAIRMAN AND C.E.O., 1995 nZfl 6/97 PERSONAL STAKE QWEST COMMUNICATIONS $44.9 BILLION* IN COMPANY: S80S2 MILLION

Nacchio quit AT&T in 1996 when he was passed over for the C.E.O. job, but he's getting his revenge: Qwest, which offers high-speed Internet access, has such a high market value that it's taking over U S West for about $50 billion in stock (though shareholders criticized Nacchio for talking with German suitor Deutsche Telekom before getting to the altar with U S West). Nacchio is the son of a Brooklyn bartender (his earliest memory: the 1955 Dodgers-Yankees World Series) and has lived in all five boroughs of New York. Now he commutes every weekend between New Jersey (where his youngest son is in high school) and Qwest's Denver headquarters, spending weeknights at the Hyatt next door.

♦THREE TIMES GREATER THAN XEROX.

FOR DETAILS, SEE CREDITS PAGE

CONTINUED ON PAGE 149

CONTINUED FROM PAGE 142

JONATHAN NELSON

CO-FOUNDER AND C.E.O., 1993 ITTia 2/00 MARKET PERSONAL STAKE ORGANIC AGE: 32 FOUNDED: VALUE: S2.4 BILLION IN COMPANY: $1.6 BILLION

How he made it Cyberpunk types in San Francisco were shocked when Nelson became a billionaire from the I.P.O. of his Web-design studio. They remembered Nelson's roots at Cyborganic, an idealistic counterculture scene that held weekly potlucks at its group house in the barrio in the early 1990s. Nelson quickly made the leap to capitalism, attracted clients like Starbucks and Blockbuster, and somehow kept control of two-thirds of Organic's stock for himself.

PETER NEUPERT

PRESIDENT AND C.E.O., 1998 fug 7/99 MARKET PERSONAL STAKE DRUGSTORE.COM AGE: 44 FOUNDED: VALUE: SI BILLION IN COMPANY: $40 MILLION

How he mode it A philosophy major at Colorado College—he likes Wittgenstein and Heidegger—Neupert became a Microsoft executive and the point man for Bill Gates's deals with NBC. He reportedly turned down the famed venture capitalist John Doerr's offers—three times—to run a start-up. Finally, Neupert acquiesced, and he's made Drugstore.com the No. 1 Web site for prescription drugs, with 700,000 customers. Amazon.com and Rite-Aid are big investors.

KEVIN O'CONNOR

CO-FOUNDER AND C.E.O., 1996 IT7i*l 2/98 MARKET PERSONAL STAKE DOUBLECLICK AGE: FOUNDED: VALUE: SI3.9 BILLION* IN COMPANY: SI.2 BILLION

How he mode it Doubleclick is the company that forced naysayers to take "Silicon Alley" seriously. As the advertising rep for 1,500 Web sites, it sells 11 billion ads a month, seen by 100 million consumers—and it tracks what they view and buy. O'Connor is such a techno-capitalist that he gave his children middle names after Thomas Edison and Ayn Rand. But privacy activists deplore DoubleClick's power to compile data about individuals.

•MORE THAN THREE TIMES GREATER THAN MATTEL.

JASON OLIM

CO-FOUNDER, C.E.O., AND 1994 IIOH 2/98 MARKET PERSONAL STAKE PRESIDENT, CDNOW AGE: FOUNDED: VALUE: $282.7 MILLION IN COMPANY: $27.6 MILLION

How he made it Olim, a Brown-educated computer scientist and amateur musician, had trouble finding a Miles Davis album in a record store, so he envisioned a Web site with a huge selection of CDs. He started it in his parents' basement and ran the company on his credit cards. Today his Web site is the sixth-biggest merchant on the Web.

PIERRE OMIDYAR AND 2JEFF SKOLL

'FOUNDER AND CHAIRMAN, EBAY AGE: FOUNDED: 1995 ITTiq 9/98 MARKET $23.6 BILLION* PERSONAL STAKE $6.9 BILLION VALUE: IN COMPANY:

2VICE PRESIDENT, MARKET PERSONAL STAKE STRATEGIC PLANNING, EBAY AGE: FOUNDED: I.P.O.: VALUE: $23.6 BILLION1' IN COMPANY: $4.2 BILLION

How they made it Omidyar, a programmer, co-founded a start-up at 24, which was bought by Microsoft when he was 26, but that was only a start. He then conceived of eBay, the on-line auction site, inspired by his wife, who wanted a better way to collect Pez dispensers. Early on he recruited Skoll, a Stanford M.B.A., who turned down $250,000 a year from another company to work for eBay for no salary at first (he still holds 18.9 percent of the stock). Now that both are billionaires, Omidyar spends more time in his native Paris, and Skoll says he would like to write a historical novel that would be a cross between the styles of James Michener and Ayn Rand.

•GREATER THAN SEARS.

JOSEPH PARK

CO-FOUNDER AND C.E.O., MARKET KOZMO.COM AGE: FOUNDED: VALUE: PRIVATELY HELD

How he mode it Kozmo, along with Urbanfetch, is the salvation of big-city yuppies who are too worn out at night to walk the two blocks to the comer store and would rather place orders on a Web site than talk to a lowly human clerk on the phone. It delivers videos as well as CDs, DVDs, magazines, junk food, toothpaste—and books from Amazon.com (which recently invested $60 million in the start-up). Co-founder Park quit his job at Goldman Sachs to try to make real money on the Web. He plans to take Kozmo public this year.

ROBERT PITTMAN

PRESIDENT AND C.O.O., AOL AGE: FOUNDED: 1985 IfTia 3/92 MARKET $141.5 BILLION PERSONAL STAKE $882.2 MILLION VALUE: IN COMPANY:

Pittman played a key role in the merger between AOL and Time Warner (he's known Jerry Levin for two decades) and will be vital to making it work. His background is almost absurdly colorful: the son of a United Methodist minister in Mississippi, he lost an eye in a horse-riding accident, dropped out of college, and worked as a radio disc jockey before helping to start MTV.

DAVID POTTRUCK

PRESIDENT AND CO-C.E.O., 1973 H2H 9/87 MARKET PERSONAL STAKE CHARLES SCHWAB AGE: FOUNDED: VALUE: $37.3 BILLION IN COMPANY: $653 MILLION

Pottruck, six one and 235 pounds, was M.V.P. of the University of Pennsylvania's football team and was disappointed that the pros didn't draft him. He turned down a free-agent tryout with the Miami Dolphins and got a Wharton M.B.A. instead. Though he had never used a PC. before 1995, he transformed Schwab, the biggest discount broker, with a push for on-line stock trading. Pottruck, thrice married, writes poetry and does squats with 300-pound weights.

STEPHEN RIGGIO

VICE-CHAIRMAN, 1997 ilTiW 5/99 MARKET PERSONAL STAKE BARNESANDNOBLE.COM AGE: FOUNDED: VALUE: $1.2 BILLION IN COMPANY: $6.7 MILLION

Barnes & Noble has unmatched power in the bricks-and-mortar bookstore business, but it has struggled to catch up with Amazon.com in on-line sales. B&N chief Leonard Riggio installed his brother Stephen to run the virtual store, which now has 5.2 million customers to Amazon's 13.6 million. Still, B&N is the seventh-biggest merchant on the Web and shouldn't be underestimated.

MICHAEL ROBERTSON

CHAIRMAN AND C.E.O., MARKET PERSONAL STAKE MP3.COM AGE: FOUNDED: 1997 7/99 VALUE: $1.3 BILLION IN COMPANY: $590 MILLION

Roberston grew up with fundamentalist parents who didn't want him to listen to pop tunes, so it's ironic that he's become the man who is shaking up the music industry. MP3.com lets fans download songs, bypassing the record labels and giving higher royalties to the artists. The day that MP3 went public, Alanis Morissette made a paper profit of $41 million from stock she had taken for letting the company sponsor her tour—and Roberston made $868 million.

FOR DETAILS, SEE CREDITS PAGE

JARED SCHUTZ

FOUNDER AND CHAIRMAN, MARKET PROFLOWERS.COM AGE: FOUNDED: VALUE: PRIVATELY HELD

How he made it: Schutz's new worldwide flower-delivery service will profit from promotional tie-ins with his other venture. Blucmountainarts.com, the fabulously successful purveyor of E-mail greeting cards, which his family sold last year to Excite@Homc for $780 million. Schutz is a real-life incarnation of the Michael J. Fox character on Family Tics, the ambitious business-minded son of hippies. In 1971, two years after his parents drove to Woodstock in their "Freedom" car, they started selling posters with her sentimental poetry and his art. In 1996, as the Web boomed, Jared helped them start a Web site for e-greetings, which now attracts more than 16 million people a month.

GEORGE SHAHEEN

PRESIDENT AND C.E.O., WEBVAN AGE: FOUNDED: 1996 nig 11/99 MARKET $4 BILLION* PERSONAL STAKE $83.1 MILLION VALUE: IN COMPANY:

How he made it: Wcbvan aims to deliver groceries to the customer's door within 30 minutes—an idea that it's taking national. It's the brainchild of Louis Borders, who founded the Borders bookstore chain. Given the huge stakes—$1 billion to build 26 distribution centers, an estimated $100 million on ads—the backers (including the venture capitalists behind Yahoo and eBay) wanted to install a supertrustworthy C.E.O. before Webvan's I.P.O. They hired Shaheen, who was C.E.O. of Andersen Consulting. Within weeks his stock was worth nine figures. Its value has since dropped.

•THIRTY-EIGHT TIMES GREATER THAN GRAND UNION.

ELLEN SIMINOFF

SENIOR VICE PRESIDENT, YAHOO AGE: FOUNDED: 1994 mg 4/96 MARKET $97 BILLION" VALUE:

How she made it Yahoo's boyish founders are famous for their nice-guy personas. It falls to SiminofT, their strategic planner, to play the heavy, turning away a deluge of companies that want to get their "content" in front of the Web site's 44 million viewers. Though she very often says no, SiminofT has done hundreds of deals that have shaped the site's personality. Before joining Yahoo, the Princeton alumna made millions bartering TV shows for ad time in Eastern Europe.

•MORE THAN TWO TIMES GREATER THAN MCDONALD'S.

PRADEEP SINDHU

FOUNDER AND C.T.O., 1996 IHfl 6/99 MARKET PERSONAL STAKE JUNIPER NETWORKS AGE: FOUNDED: VALUE: $42.9 BILLION* IN COMPANY: $2 BILLION

How he made it: Sindhu was a scientist at Xerox PARC, the legendary Palo Alto lab where technology was created that inspired the Macintosh. Backed by the venture capitalists at Kleiner Perkins, he founded Juniper, which creates hardware that can break the bottlenecks that slow down the Web. Wall Street loves the stock, which opened at $34 a share and within months surged to nearly $300 a share.

•TWO TIMES GREATER THAN DOW CHEMICAL COMPANY.

FOR DETAILS, SEE CREDITS PAGE

EVAN THORNLEY AND 2TRACEY ELLERY

'CO-FOUNDER AND C.E.O., MARKET PERSONAL STAKE $528.7 MILLION LOOKSMART AGE: FOUNDED: VALUE: S5.9 BILLION* IN COMPANY:

2CO-FOUNDER AND PRESIDENT, MARKET LOOKSMART AGE: FOUNDED: I.P.O.: VALUE:

How they made it: A sort of PG-ratcd alternative to Yahoo or About.com. LookSmart calls itself a "porn-free" directory, with 260 editors who provide free guidance to what's where on the Web. The husband-and-wife co-founders thought the Web was geared too much to young males and not to women or families with kids. Result: LookSmart gets 10 million visitors a month.

•GREATER THAN GOODYEAR TIRE & RUBBER.

LESLIE VADASZ

PRESIDENT, INTEL CAPITAL AGE: DED:. I.P.O.: 10/71 MARKET PERSONAL STAKE VAIIIf COMPANY $443 MILLION

How he made it: Vadasz is in charge of taking billions from Intel's cash hoard and investing in Internet start-ups as a way of promoting the digital revolutionand thus helping to sell more chips. So far he's bought stakes in more than 300 companies. He's the alter ego of another Hungarian immigrant, chairman Andy Grove. When Intel was founded in 1968, they came aboard as employees numbers three and four, and they were known as "the wild Hungarians."

•TWO TIMES GREATER THAN IBM.

JAY WALKER

VICE-CHAIRMAN AND FOUNDER, 1998 nxra 3/99 MARKET PERSONAL STAKE PRICELINE AGE: FOUNDED: VALUE: IN COMPANY: $5.1 BILLION

How he made it: Walker left Cornell to start a weekly newspaper in Ithaca, New York, which was later crushed by Gannett. Then he spent two decades on various schemes before coming up with Priceline, a Web site that lets consumers make lowball offers for airline tickets and hotel rooms. The ubiquitous ads with spokesman William Shatncr have helped boost the company's name recognition—and stock price. (Shatner, who filmed the ads in exchange for mostly stock, has made $9.4 million for his trouble.)

•MORE THAN FIVE TIMES GREATER THAN UNITED AIR LINES.

DAVID WETHERELL

CHAIRMAN AND C.E.O., CMGI AGE: FOUNDED: I.P.O.: MARKET $35.8 BILLION* PERSONAL STAKE $3.3 BILLION VALUE: IN COMPANY:

How he made it: Brought up on farms in New England, where his family raised chickens, cattle, and potatoes, the laid-back Wetherell took over a sleepy company that sold mailing lists, and utterly transformed it. After CMGI went public six years ago, he invested in then obscure start-ups like Lycos, a Yahoo competitor, and GeoCities, a host for personal Web sites. Now his stockholdings in dozens of Internet companies make him a Wall Street power player, sort of a Warren Buffett of the Web.

•GREATER THAN COMCAST CORPORATION.

ANN WINBLAD

PARTNER, HUMMER WINBLAD MARKET VENTURE PARTNERS AGE: FOUNDED: VALUE: PRIVATELY HELD

How she made it: The five-foot-two Winblad and her partner, the six-foot-ten John Hummer, a former basketball star at Princeton and in the N.B.A.. have launched a host of Web companies, such as Pets.com (with its ads featuring a sock-puppet mascot). The Knot (for wedding planning), HomeGrocer.com (grocery deliveries), and Gazoontite.com (for allergy and asthma sufferers). And she's leading gourmet store Dean & Deluca's Web foray.

ROBERT YOUNG

CHAIRMAN, RED HAT 1995 ITTia 8/99 MARKET $10.3 BILLION* PERSONAL STAKE $1.2 BILLION VALUE: IN COMPANY:

How he made it: Red Hat was one of last year's most spectacular I.P.O.'s, thanks to the market's mania for Linux, the rising alternative to Microsoft's software. Linux is free, but Red Hat charges to provide technical support. Its backers include a lineup of big hardware companies that hate being at Microsoft's mercy for their software (IBM, Compaq, Dell). Young is superstitious and says that he always wears red (socks, not hats).

•GREATER THAN THE NEW YORK TIMES COMPANY.

View Full Issue

View Full Issue

Subscribers have complete access to the archive.

Sign In Not a Subscriber?Join Now